Board Reporting for M&A

Effective board reporting for M&A builds trust, ensures oversight, leverages board expertise, and secures support for transactions. Well-structured quarterly updates and deal-specific presentations keep directors informed and engaged without overwhelming them.

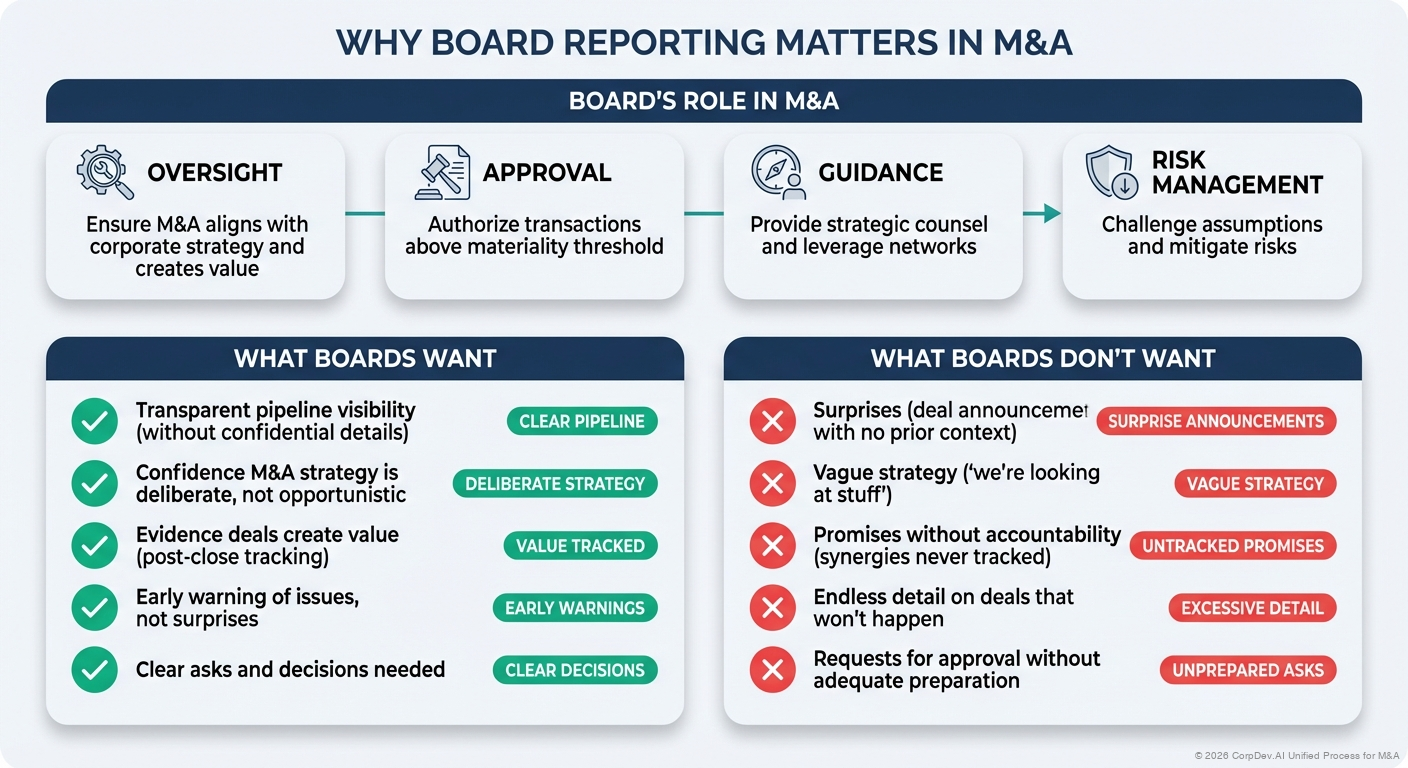

Why Board Reporting Matters

Board's Role in M&A:

- Oversight: Ensure M&A aligns with corporate strategy and creates value

- Approval: Authorize transactions above materiality threshold

- Guidance: Provide strategic counsel and leverage networks

- Risk Management: Challenge assumptions and mitigate risks

What Boards Want:

- ✅ Transparent pipeline visibility (without confidential details)

- ✅ Confidence M&A strategy is deliberate, not opportunistic

- ✅ Evidence deals create value (post-close tracking)

- ✅ Early warning of issues, not surprises

- ✅ Clear asks and decisions needed

What Boards Don't Want:

- ❌ Surprises (deal announcements with no prior context)

- ❌ Vague strategy ("we're looking at stuff")

- ❌ Promises without accountability (synergies never tracked)

- ❌ Endless detail on deals that won't happen

- ❌ Requests for approval without adequate preparation

Board Reporting Framework

Three Types of Board Engagement

┌────────────────────────────────────────────────────┐

│ 1. QUARTERLY UPDATES │

│ Regular cadence, strategic focus, pipeline view │

│ (30-60 min, part of regular board meeting) │

└────────────────────────────────────────────────────┘

┌────────────────────────────────────────────────────┐

│ 2. DEAL-SPECIFIC APPROVALS │

│ For transactions above board threshold │

│ (60-90 min, special session or board meeting) │

└────────────────────────────────────────────────────┘

┌────────────────────────────────────────────────────┐

│ 3. AD HOC UPDATES │

│ Material developments, competitive situations │

│ (Email or call between meetings) │

└────────────────────────────────────────────────────┘

Quarterly Board Updates

Frequency: Every board meeting (typically quarterly)

Duration: 30-60 minutes

Audience: Full board or M&A committee

Purpose: Strategic transparency, pipeline overview, performance tracking

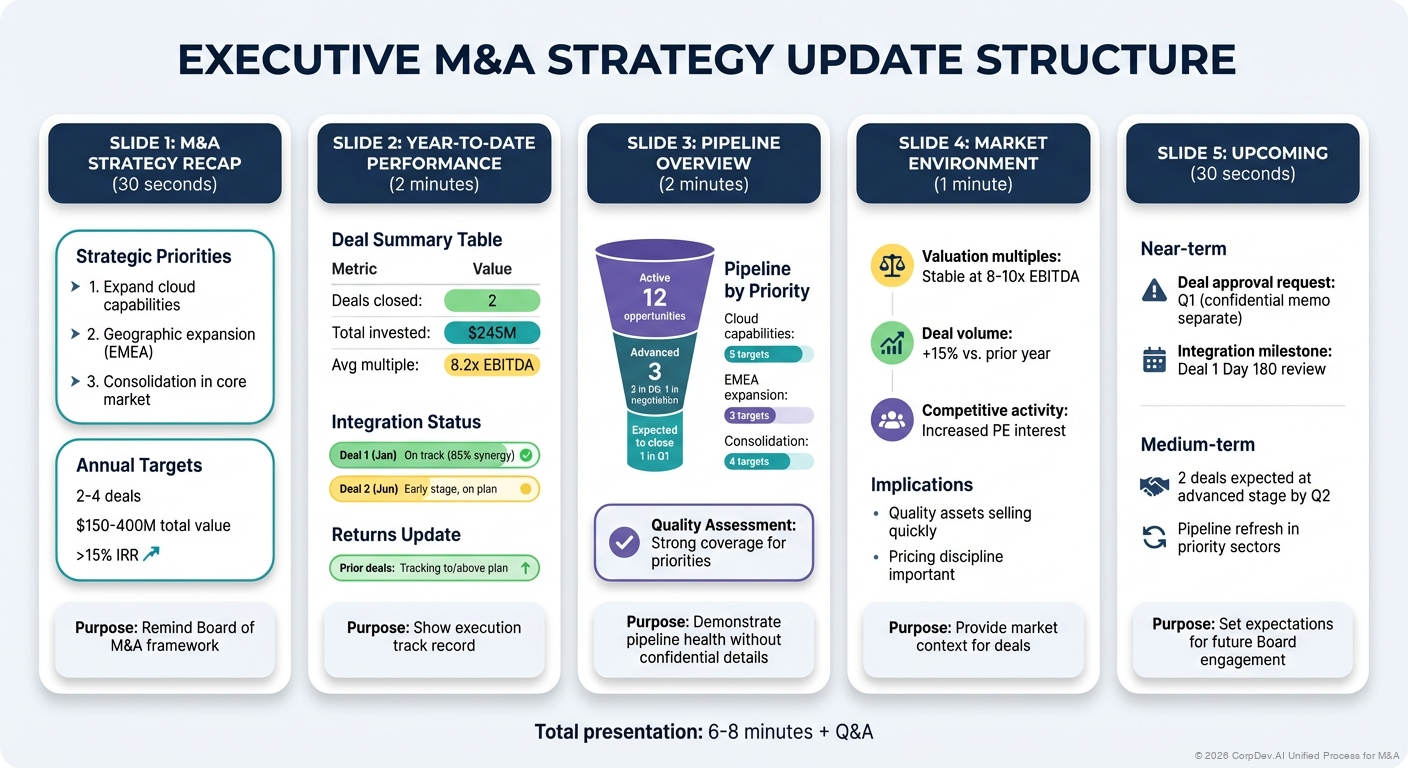

Quarterly Update Structure

Agenda (30-60 min):

- M&A Strategy Refresh (5-10 min)

- Pipeline Overview (10-15 min)

- Recent Transactions & Integration (10-15 min)

- Market Intelligence (5-10 min)

- Q&A (10-15 min)

Slide 1: M&A Strategy Refresh

Purpose: Remind board how M&A supports corporate strategy

M&A STRATEGIC PRIORITIES - [Year]

CORPORATE OBJECTIVES → M&A FOCUS AREAS

1. Accelerate cloud transition

→ Acquire cloud-native SaaS companies ($50-200M)

2. Expand enterprise customer base

→ Target companies serving Fortune 500 with high NRR

3. Build AI/ML capabilities

→ Acquire AI technology and talent ($20-100M)

4. Geographic expansion (Europe)

→ Explore European market leaders in core verticals

CAPITAL ALLOCATION:

• M&A Budget: $400-800M for [Year]

• Deal Size Range: $25-250M per transaction

• Target: 3-5 deals annually

Key Message: M&A is strategic and aligned with board-approved priorities, not random opportunism

Slide 2: Pipeline Overview

Purpose: Provide transparency into deal flow without breaching confidentiality

Balance: Show enough for visibility, not so much you compromise live negotiations

PIPELINE OVERVIEW - [Quarter]

PIPELINE SUMMARY:

• Active Opportunities: 15 deals ($1.2B total value)

• New This Quarter: 8 deals added

• Advanced: 5 deals moved to next stage

• Exited: 4 deals killed

PIPELINE BY STAGE:

┌────────────────────────────────────┐

│ Closing (1-2 deals) [██]│ Expected close: Q4

│ Diligence (2-3 deals) [████]│ Active DD in progress

│ LOI Stage (2-4 deals) [██████]│ Term sheet negotiations

│ Active Pipeline (5-10) [███████████]│ Mutual interest

│ Early Stage (10-20) [███████████ ]│ Exploratory discussions

└────────────────────────────────────┘

NEAR-TERM PIPELINE:

• Deal A (Cloud Security, $150-200M): In diligence, IC approved LOI

• Deal B (AI Analytics, $50-75M): LOI negotiation, expect sign Nov

• Deal C (SaaS, $100-150M): Active discussions, high strategic fit

NOTE: Specific company names withheld per confidentiality agreements.

Board will be notified when binding offers are submitted.

Best Practices:

- Aggregate numbers, not individual target names (unless at LOI+ stage)

- Show stage distribution (healthy pipeline has deals across all stages)

- Highlight deals likely to need board approval soon

- Be transparent about kills (shows discipline)

Slide 3-4: Recent Transactions & Integration

Purpose: Demonstrate value creation and accountability

RECENT TRANSACTIONS (Last 12 Months)

┌──────────────────────────────────────────────────────┐

│ CLOUDRE ACQUISITION - Closed Oct 2024 │

├──────────────────────────────────────────────────────┤

│ Deal Size: $200M (3.5x Revenue, 11.5x EBITDA) │

│ Strategic Rationale: Cloud security platform │

│ │

│ Integration Status (30 days post-close): │

│ • Employee Retention: 98% (vs. 90% target) 🟢 │

│ • Customer Retention: 99% (vs. 95% target) 🟢 │

│ • Synergies: $3.2M captured (vs. $3.5M plan) 🟡 │

│ • Milestones: 90% on-time 🟢 │

│ │

│ Year 1 Outlook: On track to deliver $14M synergies │

└──────────────────────────────────────────────────────┘

┌──────────────────────────────────────────────────────┐

│ DATAANALYTICS ACQUISITION - Closed Jan 2024 │

├──────────────────────────────────────────────────────┤

│ Deal Size: $150M (4.2x ARR) │

│ Strategic Rationale: AI/ML analytics capabilities │

│ │

│ Performance (9 months post-close): │

│ • Revenue vs. Plan: 103% 🟢 │

│ • EBITDA vs. Plan: 108% 🟢 │

│ • Synergies: $28M captured (vs. $30M Y1 plan) 🟡 │

│ • Integration: 95% milestones complete 🟢 │

│ │

│ Update: Exceeding plan, strong cross-sell traction │

└──────────────────────────────────────────────────────┘

Portfolio Performance Summary:

| Deal | Vintage | IRR (Underwrit) | IRR (Actual) | Synergy Capture | Status |

|---|---|---|---|---|---|

| CloudSecure | 2024 | 18.5% | TBD (6mo) | 88% | 🟢 On Track |

| DataAnalytics | 2024 | 22.1% | 24.5% | 93% | 🟢 Exceeding |

| CyberTech | 2023 | 16.8% | 14.2% | 75% | 🟡 Below Plan |

| SaaSCo | 2023 | 19.3% | 21.8% | 102% | 🟢 Exceeding |

Portfolio Avg: 18.8% underwriting → 20.2% actual (24 mo avg) 🟢 Strong Performance

Key Message: We deliver on promised returns and track rigorously post-close

Slide 5: Market Intelligence

Purpose: Keep board informed on competitive landscape and valuation trends

MARKET INTELLIGENCE - [Quarter]

COMPETITIVE M&A ACTIVITY:

• Competitor X acquired Y Corp for $300M (8.5x EBITDA)

→ Strategic rationale: European expansion

→ Implication: Validates our Europe strategy, may increase valuations

• Competitor Z acquired AI Startup for $120M

→ Strategic rationale: AI capabilities similar to our priority

→ Implication: Competitive pressure to move faster on AI M&A

VALUATION TRENDS:

• SaaS multiples: 4.2x ARR (down 15% from Q2 peak)

• Cybersecurity: 10.5x EBITDA median

• AI/ML: 5-7x ARR for growth companies

→ Observation: More favorable buying environment than 12 months ago

MARKET OPPORTUNITIES:

• 3 high-quality targets in cloud security likely to come to market Q4-Q1

• PE firm X exploring exit of portfolio company (strong fit with our priorities)

• Distressed opportunities emerging in over-leveraged VC-backed companies

Key Message: We're monitoring the landscape and have good market intelligence

Slide 6: Requests for Board

Purpose: Leverage board expertise and networks

REQUESTS FOR BOARD GUIDANCE

STRATEGIC QUESTIONS:

1. Europe Expansion: Should we prioritize European M&A or organic growth?

→ Board feedback on market entry strategy and timing

2. Deal Size: Comfort with larger transformational deal ($400-500M)?

→ One large platform vs. multiple bolt-ons

NETWORK LEVERAGE:

3. Target Access: [Board Member A], can you introduce us to [Company X]?

→ Company X CEO is in your network per LinkedIn

4. Market Intelligence: [Board Member B], thoughts on AI M&A trends?

→ Your experience in AI sector would be valuable

UPCOMING APPROVALS:

5. Deal A and Deal B likely to request board approval in Q4

→ Pre-wire and prepare for special board meeting if needed

Key Message: We value board's expertise and want to leverage their networks and experience

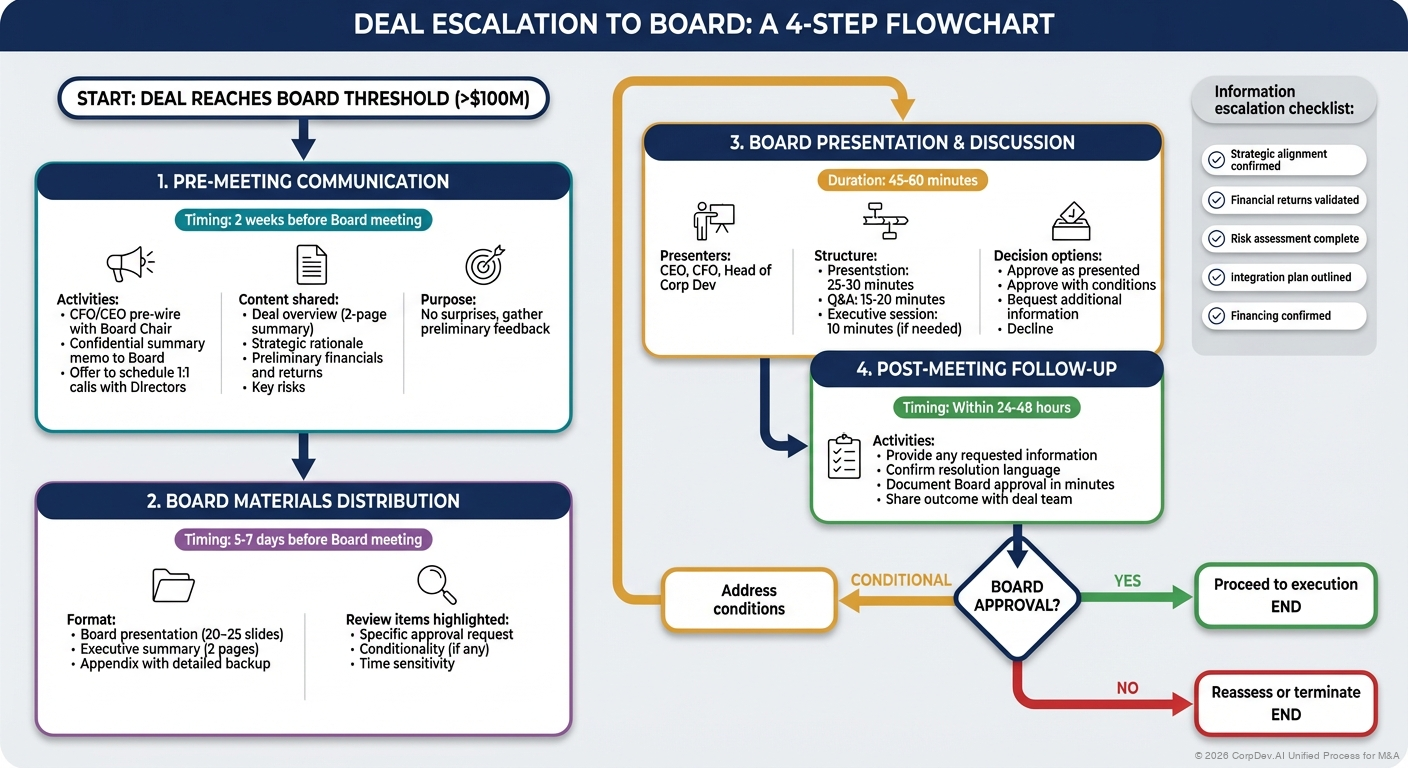

Deal-Specific Board Approvals

When Required: Typically for deals above threshold (e.g., >$100M, >10% market cap, strategic importance)

Format: Special board session or extended time in regular board meeting (60-90 min)

Deliverables: Full IC presentation + board memo

Board Approval Agenda

[0-5 min] Executive Summary

- Deal overview: target, price, structure, timing

- Strategic rationale (2-3 sentences)

- Financial highlights: IRR, NPV, EPS impact

- Recommendation: Approve / Approve with conditions

[5-15 min] Strategic Rationale

- Why this deal aligns with corporate strategy

- Market opportunity and competitive positioning

- Why this target vs. alternatives

- Why now

[15-30 min] Financial Analysis

- Valuation (DCF, comps, precedents)

- Returns (IRR, NPV, payback, ROIC)

- Pro forma impact (P&L, balance sheet, credit metrics)

- Scenarios (upside, base, downside)

[30-40 min] Synergies & Value Creation

- Synergy details (cost and revenue)

- Integration approach

- Value creation bridge

[40-50 min] Risks & Mitigations

- Key risks

- Downside scenario

- Mitigation plans

[50-75 min] Q&A & Discussion

- Board member questions

- Deeper dives on concerns

- Discussion and debate

[75-90 min] Decision

- Board vote: Approve / Approve with conditions / Decline / Defer

→ See IC Presentation Guide for detailed deck structure

Board Approval Memo Template

Written Memo (5-10 pages) sent 5-7 days before board meeting

BOARD APPROVAL MEMO

[Deal Name] Acquisition

TO: Board of Directors

FROM: [CEO Name], CEO

RE: Request for Approval of [Target] Acquisition

DATE: [Date]

EXECUTIVE SUMMARY

We are requesting Board approval to acquire [Target Company], a [description]

for $[X] million. This acquisition directly supports our strategic priority to

[strategic rationale] and is expected to deliver [X]% IRR and $[X]M in NPV.

RECOMMENDATION: Approve acquisition at purchase price of $[X]M

TRANSACTION OVERVIEW:

• Target: [Company Name], [sector], [geography]

• Purchase Price: $[X]M ([X.X]x Revenue, [X.X]x EBITDA)

• Structure: [Cash/Stock/Combination]

• Financing: [Sources]

• Expected Close: [Q/Year]

STRATEGIC RATIONALE:

[2-3 paragraphs explaining why this acquisition makes strategic sense,

how it fits corporate priorities, and what value it creates]

FINANCIAL SUMMARY:

• IRR (Base Case): [X]% (vs. [X]% hurdle)

• NPV: $[X]M

• EPS Impact: [X]% accretive in Year 2

• Synergies: $[X]M PV over 3 years

• Pro Forma Leverage: [X.X]x (vs. [X]x covenant)

KEY RISKS & MITIGATIONS:

1. [Risk #1]: [Mitigation]

2. [Risk #2]: [Mitigation]

3. [Risk #3]: [Mitigation]

APPROVAL REQUEST:

The Board is requested to approve:

1. Execution of definitive merger agreement at $[X]M purchase price

2. Financing plan as outlined (debt, equity, cash)

3. Management authority to complete closing conditions

[Attached: Full IC presentation, financial model, diligence summary]

Ad Hoc Board Updates

When: Material developments between regular board meetings

Format: Email, call, or emergency meeting

Triggers:

- Competitive situation requiring fast decision

- Deal break or material change to approved transaction

- Unsolicited inbound offer

- Regulatory or legal issues

- Major integration challenges on recent deal

Ad Hoc Update Template (Email)

TO: Board of Directors

FROM: [CEO], [CFO], [Head of Corp Dev]

SUBJECT: M&A Update - [Situation]

DATE: [Date]

SITUATION:

[2-3 sentences describing what happened]

IMPLICATIONS:

• [Impact on strategy, financials, timing]

• [Board action needed or FYI only]

PROPOSED ACTION:

[What management proposes to do]

REQUEST:

[Approval needed? Input requested? Or FYI only?]

NEXT STEPS:

• [Timeline]

• [When board will hear more]

Please reply with any questions or concerns. We're available for a call

if the board would like to discuss.

Example Scenarios:

Competitive Situation:

"We've been in negotiations with CloudSecure for 60 days. Yesterday, we learned Competitor X submitted a higher bid. We believe we need to increase our offer from $180M to $200M to remain competitive. This is within our board-approved authority of up to $250M for cloud security acquisitions, but wanted to notify the board given the material change."

Deal Break:

"As previously disclosed, we were in diligence on DataCo ($150M). This week, we discovered a material customer concentration issue (top customer = 45% of revenue vs. 15% represented). We have decided to terminate negotiations and will not pursue this acquisition. No further board action needed, but wanted to inform you promptly."

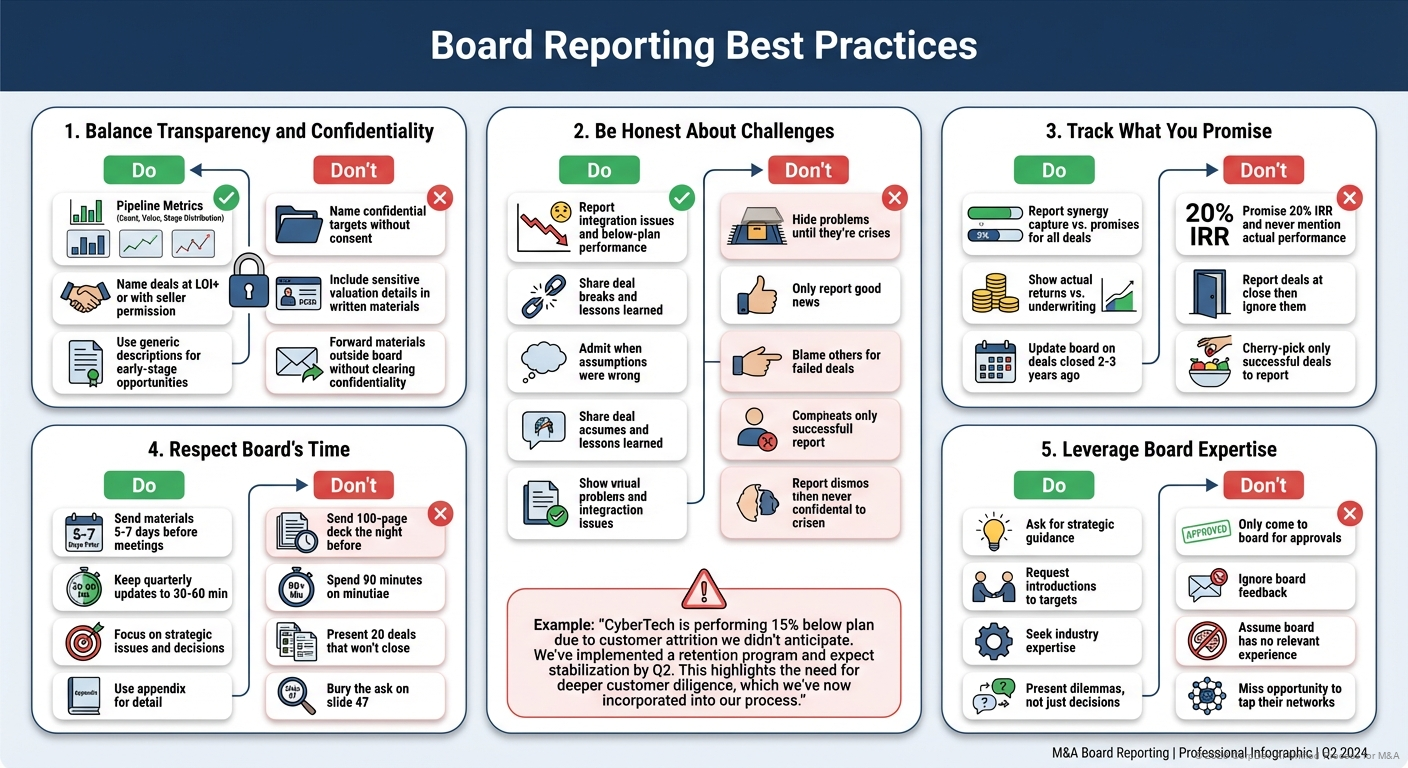

Board Reporting Best Practices

1. Balance Transparency and Confidentiality

Do:

- Show pipeline metrics (count, value, stage distribution)

- Name deals at LOI+ stage or with seller permission

- Use generic descriptions for early-stage opportunities

Don't:

- Name confidential targets without consent

- Include sensitive valuation details in written materials

- Forward materials outside board without clearing confidentiality

2. Be Honest About Challenges

Do:

- Report integration issues and below-plan performance

- Share deal breaks and lessons learned

- Admit when assumptions were wrong

Don't:

- Hide problems until they're crises

- Only report good news

- Blame others for failed deals

Example: "CyberTech is performing 15% below plan due to customer attrition we didn't anticipate. We've implemented a retention program and expect stabilization by Q2. This highlights the need for deeper customer diligence, which we've now incorporated into our process."

3. Track What You Promise

Do:

- Report synergy capture vs. promises for all deals

- Show actual returns vs. underwriting

- Update board on deals closed 2-3 years ago

Don't:

- Promise 20% IRR and never mention actual performance

- Report deals at close then ignore them

- Cherry-pick only successful deals to report

4. Respect Board's Time

Do:

- Send materials 5-7 days before meetings

- Keep quarterly updates to 30-60 min

- Focus on strategic issues and decisions

- Use appendix for detail

Don't:

- Send 100-page deck the night before

- Spend 90 minutes on minutiae

- Present 20 deals that won't close

- Bury the ask on slide 47

5. Leverage Board Expertise

Do:

- Ask for strategic guidance

- Request introductions to targets

- Seek industry expertise

- Present dilemmas, not just decisions

Don't:

- Only come to board for approvals

- Ignore board feedback

- Assume board has no relevant experience

- Miss opportunity to tap their networks

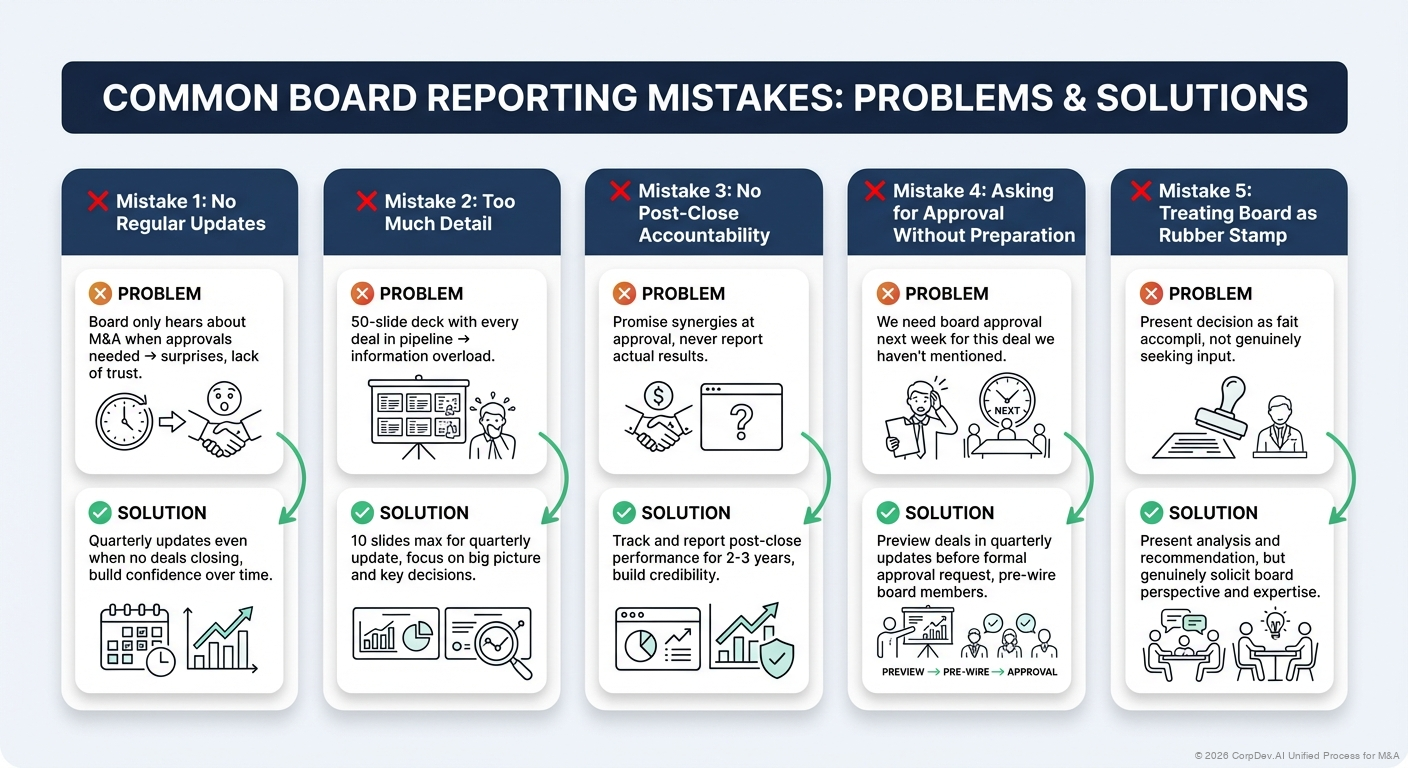

Common Board Reporting Mistakes

❌ Mistake 1: No Regular Updates

Problem: Board only hears about M&A when approvals needed → surprises, lack of trust

Solution: Quarterly updates even when no deals closing, build confidence over time

❌ Mistake 2: Too Much Detail

Problem: 50-slide deck with every deal in pipeline → information overload

Solution: 10 slides max for quarterly update, focus on big picture and key decisions

❌ Mistake 3: No Post-Close Accountability

Problem: Promise synergies at approval, never report actual results

Solution: Track and report post-close performance for 2-3 years, build credibility

❌ Mistake 4: Asking for Approval Without Preparation

Problem: "We need board approval next week for this deal we haven't mentioned"

Solution: Preview deals in quarterly updates before formal approval request, pre-wire board members

❌ Mistake 5: Treating Board as Rubber Stamp

Problem: Present decision as fait accompli, not genuinely seeking input

Solution: Present analysis and recommendation, but genuinely solicit board perspective and expertise

Board Reporting Checklist

Quarterly Update Checklist

- M&A strategy refresh (how M&A supports corporate objectives)

- Pipeline summary (count, value, stage distribution)

- Near-term pipeline highlights (deals likely to advance)

- Recent transaction updates (integration status)

- Post-close performance (synergy capture, returns vs. plan)

- Market intelligence (competitive M&A, valuation trends)

- Requests for board (guidance, introductions, upcoming approvals)

- Materials sent 5-7 days before meeting

- Presentation time: 30-60 min including Q&A

Deal Approval Checklist

- Board memo (5-10 pages) sent 5-7 days before meeting

- Full IC presentation deck with appendix

- Financial model available for review

- Diligence summary (key findings)

- Clear recommendation (approve, price range, conditions)

- Risk assessment and downside scenario

- Financing plan and credit impact

- Integration approach and timeline

- Pre-wired with key board members

- Presentation time: 60-90 min including Q&A

Key Takeaways

- Three types of board engagement - Quarterly updates, deal approvals, ad hoc updates

- Quarterly updates build trust - Regular cadence even without deals closing

- Balance transparency and confidentiality - Show pipeline metrics without naming targets

- Post-close accountability - Track and report synergy capture and returns vs. plan

- Respect board's time - 30-60 min quarterly, materials 5-7 days in advance

- Leverage board expertise - Ask for guidance, introductions, strategic input

- Be honest about challenges - Report integration issues and below-plan performance

- No surprises - Preview deals in quarterly updates before approval requests

- Clear asks - What decision or input do you need from board?

- Build credibility over time - Consistent reporting, deliver on promises, learn from mistakes

Board reporting is not a compliance exercise—it's an opportunity to build trust, leverage expertise, and secure support for your M&A program. Boards that are informed, engaged, and confident in management's M&A capabilities are more supportive when approvals are needed.

Related Resources

- M&A Operations Overview - Complete operations framework

- Meeting Cadence & Governance - Board meeting rhythms

- Reporting & Metrics - M&A dashboards and KPIs

- IC Presentation Guide - Investment Committee presentations

- Corporate Development KPIs & Metrics - Performance tracking

© 2026 CorpDev.Ai Unified Process for M&A

Last updated: Thu Oct 30 2025 20:00:00 GMT-0400 (Eastern Daylight Time)