M&A Reporting & Metrics

Effective M&A reporting and metrics provide visibility into pipeline health, deal performance, and value creation—enabling data-driven decisions, stakeholder confidence, and continuous improvement.

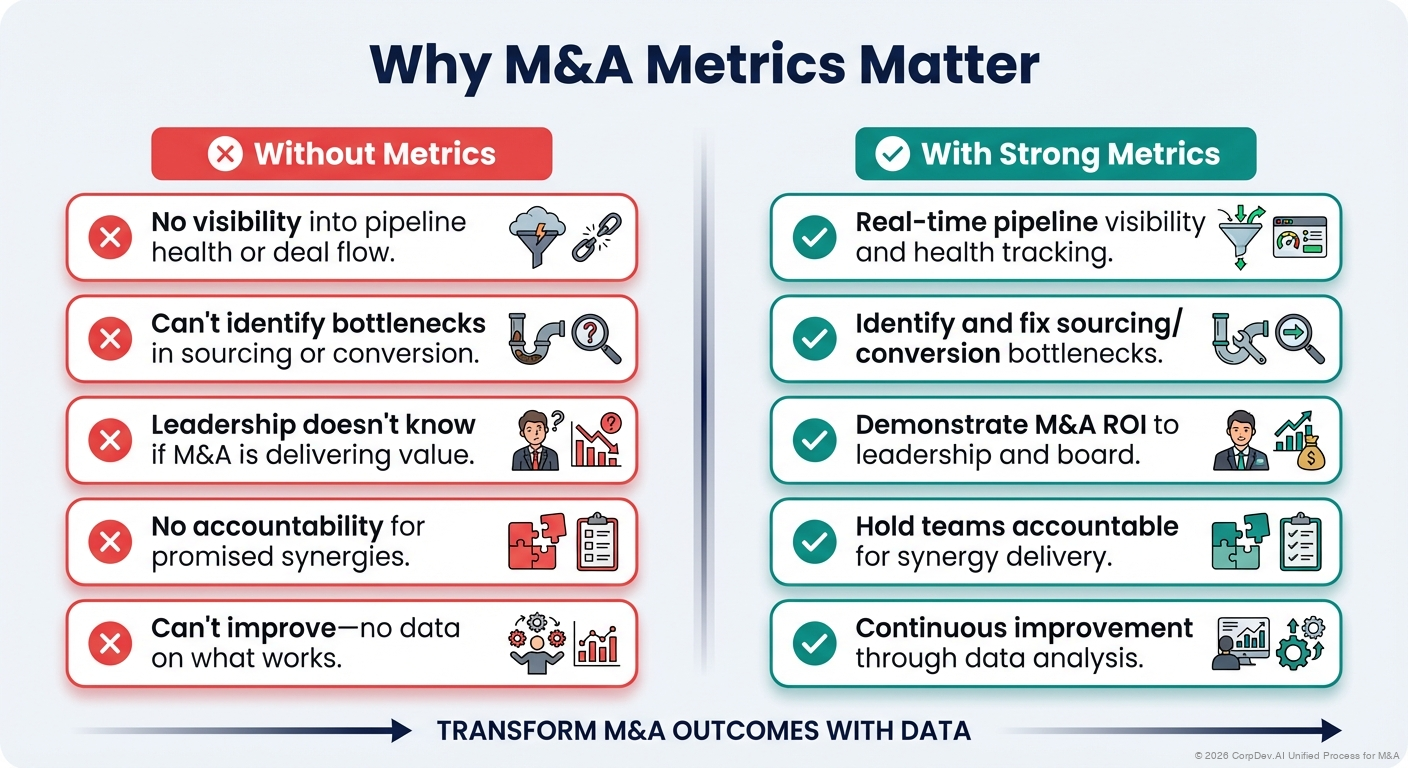

Why M&A Metrics Matter

Without Metrics:

- ❌ No visibility into pipeline health or deal flow

- ❌ Can't identify bottlenecks in sourcing or conversion

- ❌ Leadership doesn't know if M&A is delivering value

- ❌ No accountability for promised synergies

- ❌ Can't improve—no data on what works

With Strong Metrics:

- ✅ Real-time pipeline visibility and health tracking

- ✅ Identify and fix sourcing/conversion bottlenecks

- ✅ Demonstrate M&A ROI to leadership and board

- ✅ Hold teams accountable for synergy delivery

- ✅ Continuous improvement through data analysis

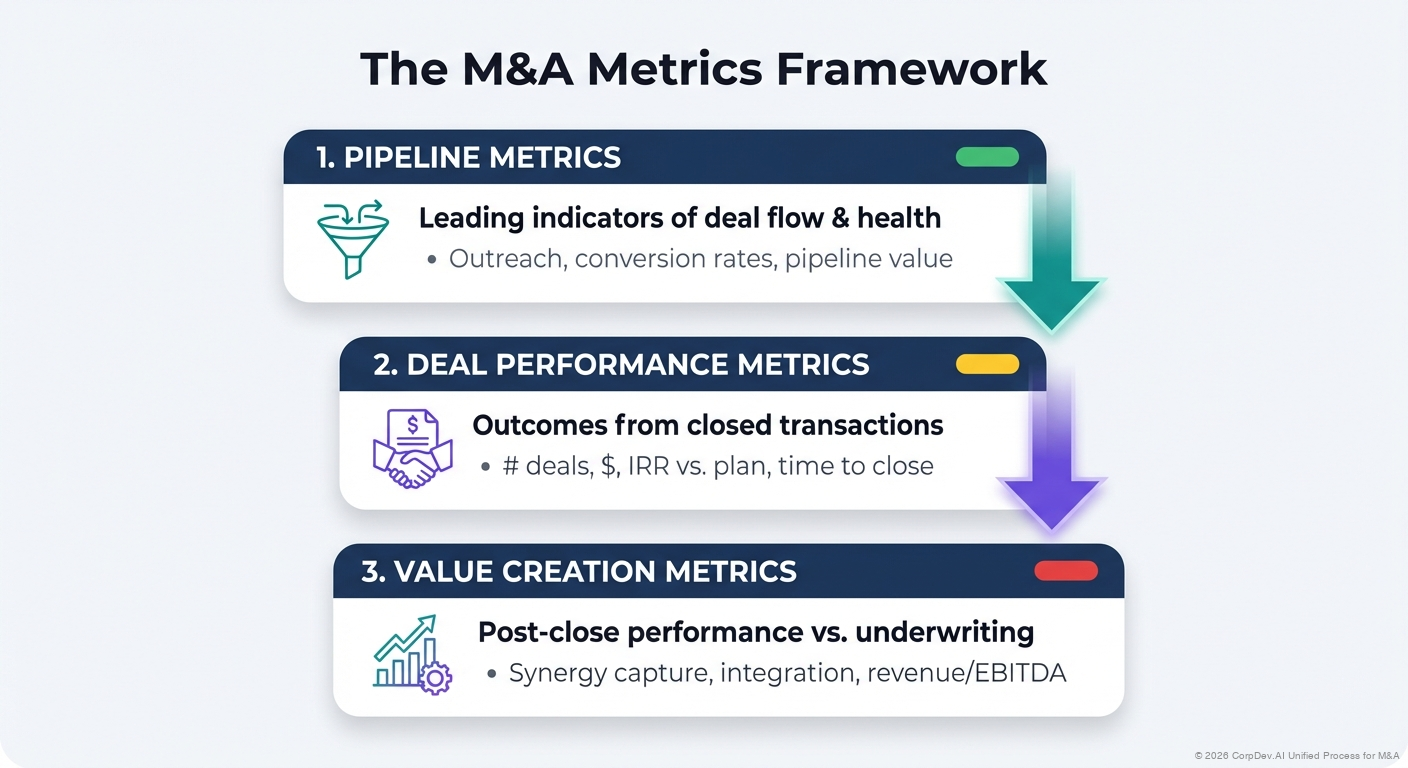

The M&A Metrics Framework

Three Metric Categories

┌────────────────────────────────────────────────────┐

│ 1. PIPELINE METRICS │

│ Leading indicators of deal flow & health │

│ (Outreach, conversion rates, pipeline value) │

└────────────────────────────────────────────────────┘

↓

┌────────────────────────────────────────────────────┐

│ 2. DEAL PERFORMANCE METRICS │

│ Outcomes from closed transactions │

│ (# deals, $, IRR vs. plan, time to close) │

└────────────────────────────────────────────────────┘

↓

┌────────────────────────────────────────────────────┐

│ 3. VALUE CREATION METRICS │

│ Post-close performance vs. underwriting │

│ (Synergy capture, integration, revenue/EBITDA) │

└────────────────────────────────────────────────────┘

1. Pipeline Metrics (Leading Indicators)

Core Pipeline KPIs

| Metric | Definition | Target | Frequency |

|---|---|---|---|

| Active Pipeline Count | # of deals in active stages | 10-20 | Weekly |

| Pipeline Value | Total EV of active opportunities | $500M-$2B | Weekly |

| New Adds | # of new deals entering pipeline | 5-10/month | Weekly |

| Deals Killed | # of deals exited from pipeline | 50-70% of total sourced | Weekly |

| Stage Distribution | % of pipeline by stage | Balanced across stages | Weekly |

| Avg. Time in Stage | Days spent in each stage | <90 days per stage | Monthly |

| Stalled Deals | # with no activity in 30+ days | <20% of pipeline | Weekly |

Pipeline Health Dashboard

PIPELINE SNAPSHOT - Week of [Date]

┌──────────────────────────────────────────────────────┐

│ PIPELINE SUMMARY │

├──────────────────────────────────────────────────────┤

│ Active Deals: 15 ($1.2B total value) │

│ New This Month: 3 │

│ Killed This Month: 2 │

│ Avg. Age: 68 days │

│ Stalled (>30 days no activity): 2 (13%) │

└──────────────────────────────────────────────────────┘

PIPELINE BY STAGE:

Closing ██ 2 deals ($200M) ← Target: Close Q4

Diligence ███ 3 deals ($450M) ← Active DD in progress

LOI Negotiation ██ 2 deals ($180M) ← IC approved, finalizing terms

Active Pipeline ████████ 8 deals ($370M) ← Mutual interest, sharing info

PIPELINE HEALTH SCORE: 🟢 82/100

✓ Good stage distribution

✓ Low stall rate (13%)

⚠️ Avg. time in LOI stage high (45 days vs. 30 target)

Sourcing Activity Metrics

| Metric | Weekly Target | Quarterly Target | Annual Target |

|---|---|---|---|

| Targets Contacted | 10-20 | 120-240 | 500-1,000 |

| Response Rate | 30-40% | 30-40% | 30-40% |

| Meetings Booked | 2-4 | 24-48 | 100-200 |

| Meetings Held | 2-4 | 24-48 | 100-200 |

| New Pipeline Adds | 1-2 | 12-24 | 50-100 |

Conversion Funnel Metrics

| Conversion | Formula | Target | Actual | Status |

|---|---|---|---|---|

| Outreach → Response | Responses / Outreach | 30-40% | 35% | 🟢 |

| Response → Meeting | Meetings / Responses | 50-60% | 45% | 🟡 |

| Meeting → Active | Active Pipeline / Meetings | 20-30% | 25% | 🟢 |

| Active → LOI | LOIs / Active Pipeline | 30-40% | 35% | 🟢 |

| LOI → Close | Closes / LOIs | 50-60% | 55% | 🟢 |

| Outreach → Close | Closes / Outreach | 1-2% | 1.5% | 🟢 |

Funnel Visualization:

1,000 Outreach

↓ 35%

350 Responses

↓ 45%

158 Meetings

↓ 25%

40 Active Pipeline

↓ 35%

14 LOIs Signed

↓ 55%

8 Deals Closed

OVERALL CONVERSION: 0.8% (outreach to close)

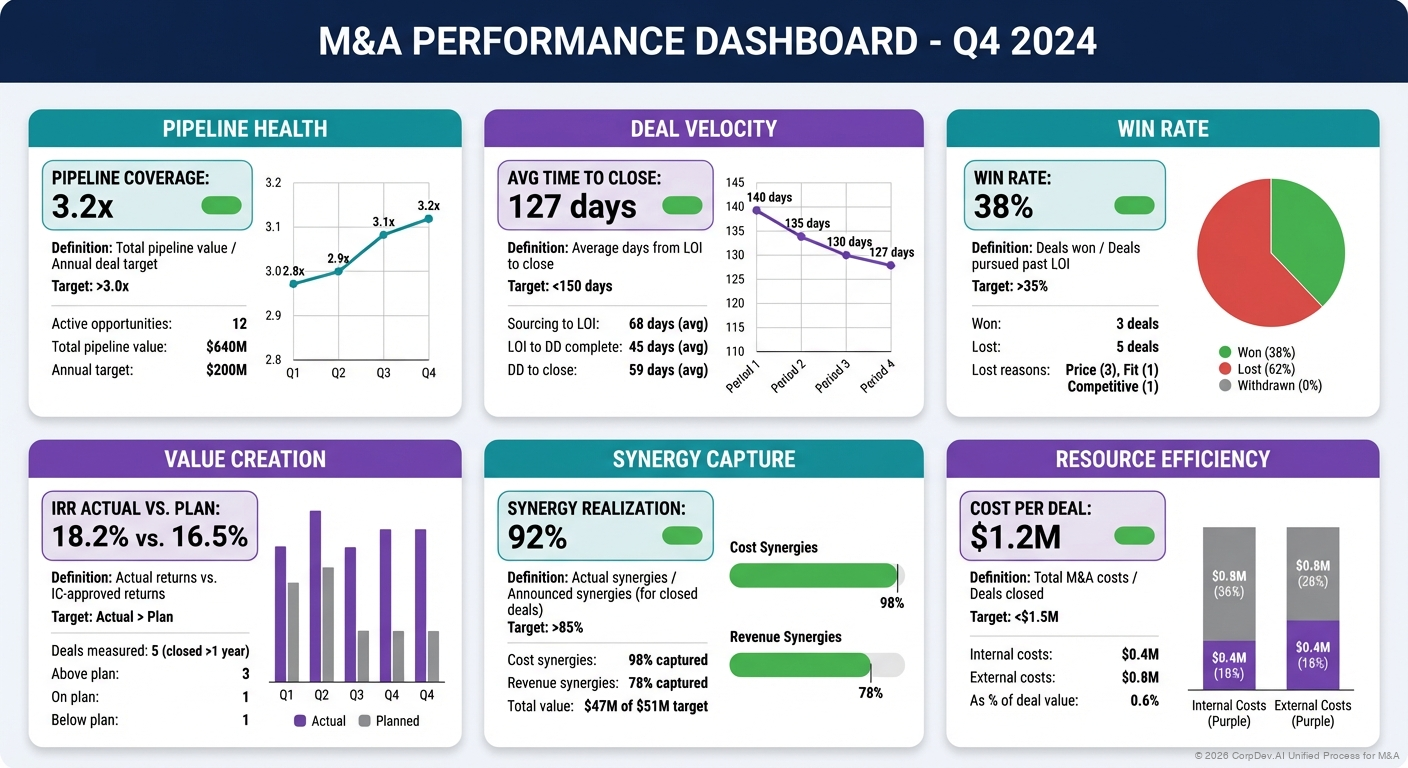

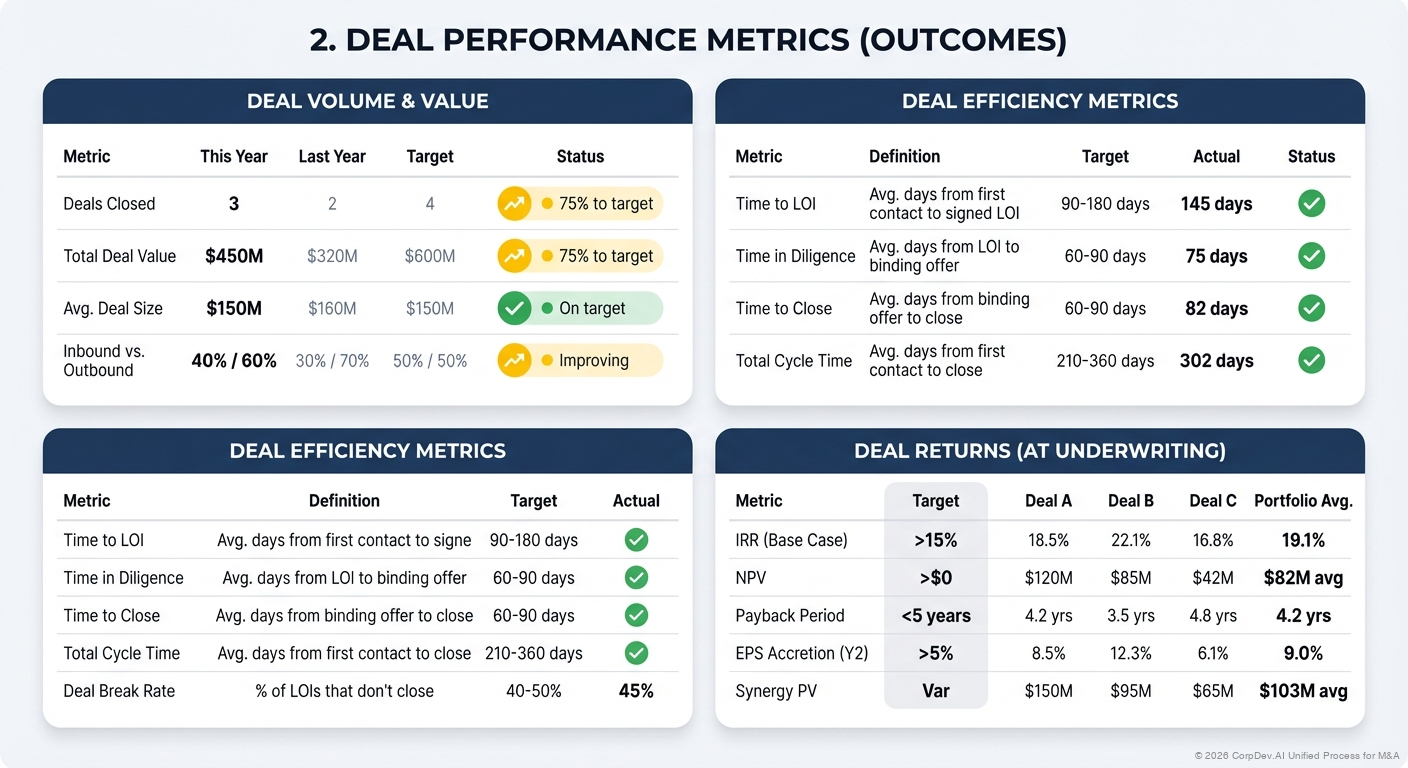

2. Deal Performance Metrics (Outcomes)

Deal Volume & Value

| Metric | This Year | Last Year | Target | Status |

|---|---|---|---|---|

| Deals Closed | 3 | 2 | 4 | 🟡 75% to target |

| Total Deal Value | $450M | $320M | $600M | 🟡 75% to target |

| Avg. Deal Size | $150M | $160M | $150M | 🟢 On target |

| Inbound vs. Outbound | 40% / 60% | 30% / 70% | 50% / 50% | 🟡 Improving |

Deal Efficiency Metrics

| Metric | Definition | Target | Actual | Status |

|---|---|---|---|---|

| Time to LOI | Avg. days from first contact to signed LOI | 90-180 days | 145 days | 🟢 |

| Time in Diligence | Avg. days from LOI to binding offer | 60-90 days | 75 days | 🟢 |

| Time to Close | Avg. days from binding offer to close | 60-90 days | 82 days | 🟢 |

| Total Cycle Time | Avg. days from first contact to close | 210-360 days | 302 days | 🟢 |

| Deal Break Rate | % of LOIs that don't close | 40-50% | 45% | 🟢 |

Deal Returns (At Underwriting)

| Metric | Target | Deal A | Deal B | Deal C | Portfolio Avg |

|---|---|---|---|---|---|

| IRR (Base Case) | >15% | 18.5% | 22.1% | 16.8% | 19.1% |

| NPV | >$0 | $120M | $85M | $42M | $82M avg |

| Payback Period | <5 years | 4.2 yrs | 3.5 yrs | 4.8 yrs | 4.2 yrs |

| EPS Accretion (Y2) | >5% | 8.5% | 12.3% | 6.1% | 9.0% |

| Synergy PV | Var | $150M | $95M | $65M | $103M avg |

3. Value Creation Metrics (Post-Close)

![]()

Synergy Capture Tracking

Deal Name: CloudSecure Acquisition

| Category | Year 1 Target | Year 1 Actual | % Achieved | Year 3 Run-Rate Target | Status |

|---|---|---|---|---|---|

| Cost Synergies | $11M | $10.2M | 93% | $40M | 🟢 On Track |

| - Headcount | $7M | $6.8M | 97% | $22M | 🟢 |

| - Procurement | $3M | $2.5M | 83% | $10M | 🟡 |

| - IT | $1M | $0.9M | 90% | $3M | 🟢 |

| Revenue Synergies | $3M | $2.1M | 70% | $15M | 🟡 At Risk |

| Total Synergies | $14M | $12.3M | 88% | $55M | 🟢 |

Integration Costs: $22M actual vs. $25M budget (🟢 Under budget)

Integration Scorecard

| Metric | Target | 30 Days | 60 Days | 90 Days | 12 Months |

|---|---|---|---|---|---|

| Milestones On-Time | >85% | 90% 🟢 | 82% 🟡 | 88% 🟢 | 91% 🟢 |

| Employee Retention | >90% | 98% 🟢 | 96% 🟢 | 94% 🟢 | 91% 🟢 |

| Customer Retention | >95% | 99% 🟢 | 98% 🟢 | 97% 🟢 | 96% 🟢 |

| Revenue vs. Plan | 100% | 102% 🟢 | 98% 🟡 | 101% 🟢 | 103% 🟢 |

| EBITDA vs. Plan | 100% | 95% 🟡 | 98% 🟡 | 102% 🟢 | 108% 🟢 |

| Synergy Capture | 100% of plan | 85% 🟡 | 90% 🟢 | 88% 🟢 | 93% 🟢 |

Portfolio Performance (All Deals)

Actual vs. Underwriting (12-24 months post-close)

| Deal | Vintage | IRR Underwrit | IRR Actual | Variance | Synergies Captured | Status |

|---|---|---|---|---|---|---|

| CloudSecure | 2024 | 18.5% | TBD (6mo) | TBD | 88% of Y1 plan | 🟢 On Track |

| DataAnalytics | 2023 | 22.1% | 20.5% | -160bps | 95% of plan | 🟢 Exceeding |

| CyberTech | 2023 | 16.8% | 14.2% | -260bps | 75% of plan | 🟡 Below Plan |

| SaaSCo | 2022 | 19.3% | 21.8% | +250bps | 102% of plan | 🟢 Exceeding |

| AIVendor | 2022 | 17.5% | 15.9% | -160bps | 82% of plan | 🟡 Below Plan |

Portfolio Average: 18.1% actual vs. 18.8% underwriting (-70bps) 🟢 Within Target

Monthly M&A Dashboard (Leadership View)

Dashboard Template

M&A MONTHLY DASHBOARD - [Month Year]

═══════════════════════════════════════════════════════

PIPELINE SUMMARY

═══════════════════════════════════════════════════════

Active Deals: 15 ($1.2B value) | New: 3 | Killed: 2

Pipeline Health: 🟢 82/100

Stalled Deals: 2 (13%)

Avg. Time in Pipeline: 68 days

UPCOMING MILESTONES:

• CloudSecure: IC presentation 11/15

• DataViz: LOI signing target 11/20

• AITech: Diligence complete 11/30

═══════════════════════════════════════════════════════

DEAL ACTIVITY (YTD)

═══════════════════════════════════════════════════════

Closed Deals: 3 ($450M) vs. Target 4 ($600M) → 75% to goal

Avg. IRR (underwriting): 19.1% vs. 15% hurdle → 🟢 Strong

Time to Close: 302 days avg. → 🟢 On target

DEALS CLOSED THIS QUARTER:

• CloudSecure ($200M) - Closed 10/15

• AIStartup ($50M) - Closed 10/28

═══════════════════════════════════════════════════════

POST-CLOSE PERFORMANCE (Last 24 Months)

═══════════════════════════════════════════════════════

Synergy Capture: 88% of plan (across 5 deals)

Integration On-Time: 89% milestones hit

Employee Retention: 92% (vs. 90% target)

Customer Retention: 96% (vs. 95% target)

DEALS REQUIRING ATTENTION:

• CyberTech: Revenue 12% below plan, synergies at 75%

Action: Monthly reviews with BU, adjusted timeline

═══════════════════════════════════════════════════════

MARKET INTELLIGENCE

═══════════════════════════════════════════════════════

• Competitor X acquired YZ Corp for $300M (8.5x EBITDA)

• SaaS multiples down 15% from peak (now 4.2x ARR median)

• 3 targets in our pipeline raised funding (may delay exits)

Reporting Cadence

Weekly (Internal Team)

Report: Pipeline Snapshot

Audience: Corp Dev team

Format: Email or Slack update (5 bullets)

Contents:

- Pipeline count and value

- New adds and kills

- Stage movements

- Upcoming milestones

- Blockers

Monthly (Leadership)

Report: M&A Dashboard

Audience: CFO, CEO, COO

Format: 1-2 page PDF + 30 min discussion

Contents:

- Pipeline summary

- Deal activity YTD

- Post-close performance

- Market intelligence

- Issues requiring decisions

Quarterly (Board)

Report: Board Update

Audience: Board of Directors

Format: 5-10 slide presentation + 30 min discussion

Contents:

- M&A strategy refresh

- Pipeline overview (high-level, no confidential details)

- Closed deals and performance

- Market trends

- Requests for guidance

→ See Board Reporting for detailed board templates

Key Performance Indicators (KPIs)

Corporate Development Team KPIs

Annual Targets:

- Deals closed: 3-5

- Total deal value: $400M-$800M

- Avg. IRR (underwriting): >15%

- Pipeline health score: >75/100

- Sourcing conversion rate: >1.5% (outreach → close)

- Time to close: <12 months avg.

Individual KPIs (VP/Director):

- Deals closed (as sponsor): 1-2/year

- IC presentations: 3-5/year

- Pipeline adds: 10-15/year

- Synergy delivery (for past deals sponsored): >85% of plan

M&A Program KPIs (Company-Level)

Strategic:

- % of M&A deals aligned with stated priorities: >90%

- Market share gains from M&A: +X% per year

- Capability gaps filled: X of Y strategic priorities

Financial:

- Aggregate IRR (actual, 2-3 years post-close): >12%

- Synergy capture rate: >85% of promised value

- ROIC on M&A capital: >WACC + 500bps

Operational:

- Employee retention (acquired companies): >90% at 12 months

- Customer retention: >95% at 12 months

- Integration milestone completion: >85% on-time

Common Reporting Mistakes

❌ Mistake 1: Reporting Activity, Not Outcomes

Problem: "We had 50 meetings this quarter!"

Solution: Focus on outcomes - deals closed, pipeline value, conversion rates, synergy delivery

❌ Mistake 2: No Post-Close Tracking

Problem: Report deals at close, never mention again

Solution: Track post-close performance for 2-3 years, report actual vs. underwriting

❌ Mistake 3: Overly Detailed Pipeline Reports

Problem: Board gets spreadsheet with 30 confidential target names

Solution: Aggregate pipeline metrics, only name deals at LOI+ stage or with board approval

❌ Mistake 4: No Trend Analysis

Problem: Point-in-time snapshots with no context

Solution: Show trends over time - is pipeline growing? Conversion improving?

❌ Mistake 5: Metrics Without Action

Problem: Report that sourcing conversion is 0.5% (below 1.5% target), but no plan to fix

Solution: Every metric below target needs action plan and owner

Metrics Tech Stack

Spreadsheet-Based (Small Teams)

Tools: Excel, Google Sheets

Pros: Free, flexible, easy to start

Cons: Manual updates, limited automation, no collaboration

Best For: 1-2 person teams, <20 active pipeline

CRM + Analytics (Mid-Sized Teams)

Tools: CorpDev.Ai, DealCloud, Affinity, Salesforce + Tableau/Looker

Pros: Automated tracking, real-time dashboards, collaboration

Cons: $25K-$100K/year (traditional tools), implementation effort

Best For: 3-5 person teams, >20 active pipeline, data-driven culture

Full M&A Platform (Large Teams)

Tools: CorpDev.Ai, DealCloud, Altvia, Datasite Analytics

Pros: End-to-end M&A workflow, pipeline + diligence + integration tracking

Cons: $100K-$250K+/year (traditional platforms), significant implementation

Best For: 6+ person teams, >5 deals/year, enterprise M&A programs

Key Takeaways

- Three metric categories - Pipeline (leading), Deal Performance (outcomes), Value Creation (post-close)

- Track conversion funnel - Outreach → Response → Meeting → Active → LOI → Close

- Pipeline health matters - Monitor count, value, stalled deals, time in stage

- Report outcomes, not activity - Deals closed and value created, not meetings held

- Post-close accountability - Track synergy capture and integration for 2-3 years

- Right frequency - Weekly (team), monthly (leadership), quarterly (board)

- Dashboards over decks - 1-2 page dashboard > 20-slide PowerPoint

- Trends > snapshots - Show performance over time, not just current state

- Metrics drive action - Every metric below target needs owner and improvement plan

"What gets measured gets managed." M&A metrics provide visibility, accountability, and continuous improvement. Companies that rigorously track pipeline, deal performance, and post-close value creation consistently outperform those that don't.

Related Resources

- M&A Operations Overview - Complete operations framework

- Sourcing Cadence - Pipeline development and tracking

- Board Reporting - Board-level M&A reporting

- Corporate Development KPIs & Metrics - Detailed KPI frameworks

- Value Creation Planning - Synergy tracking post-close

© 2026 CorpDev.Ai Unified Process for M&A

Last updated: Thu Oct 30 2025 20:00:00 GMT-0400 (Eastern Daylight Time)