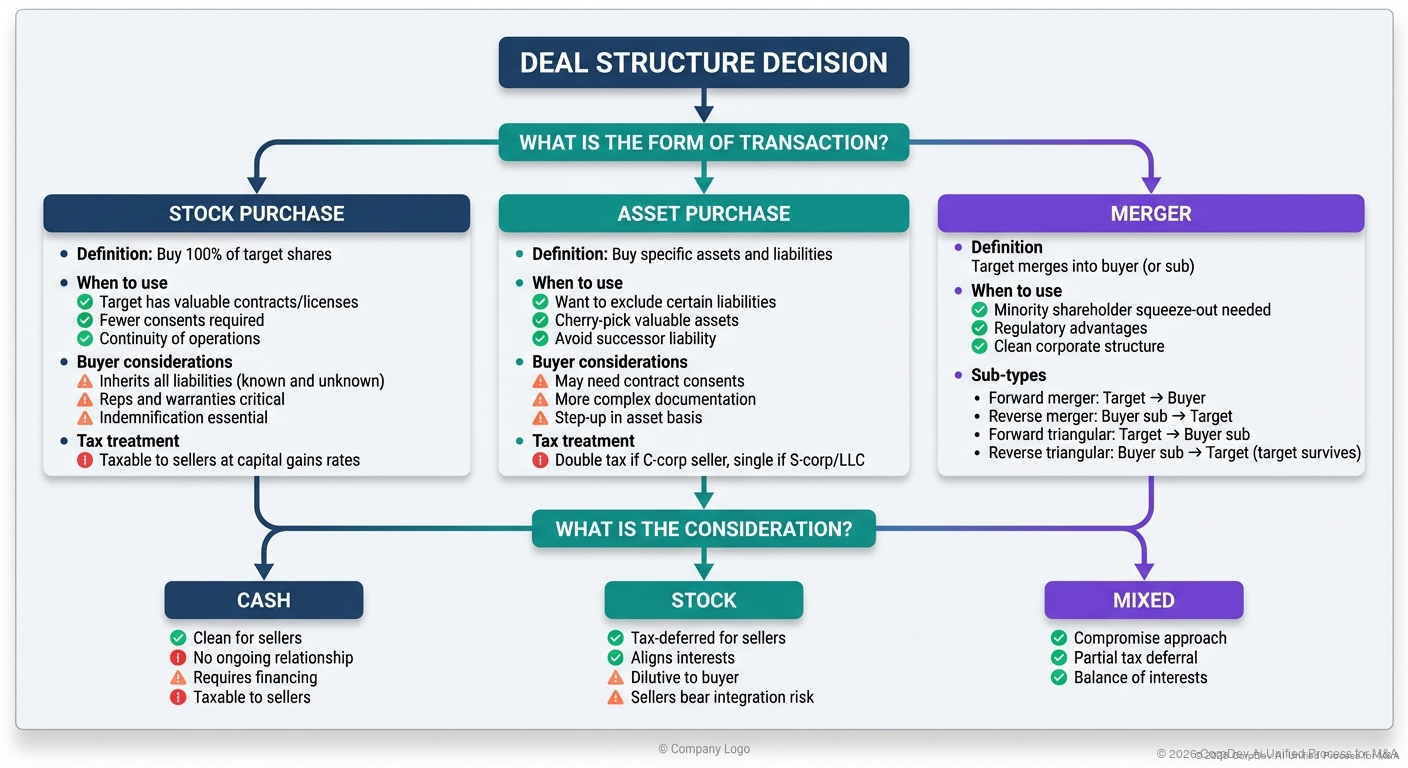

Deal Structure Overview

Deal structure is as important as price. The right structure can bridge valuation gaps, allocate risk appropriately, and optimize tax outcomes for both parties.

Deal structure encompasses how the transaction is legally organized, how consideration is paid, and how risks and rewards are allocated between buyer and seller. This guide covers the fundamental decisions in structuring M&A transactions.

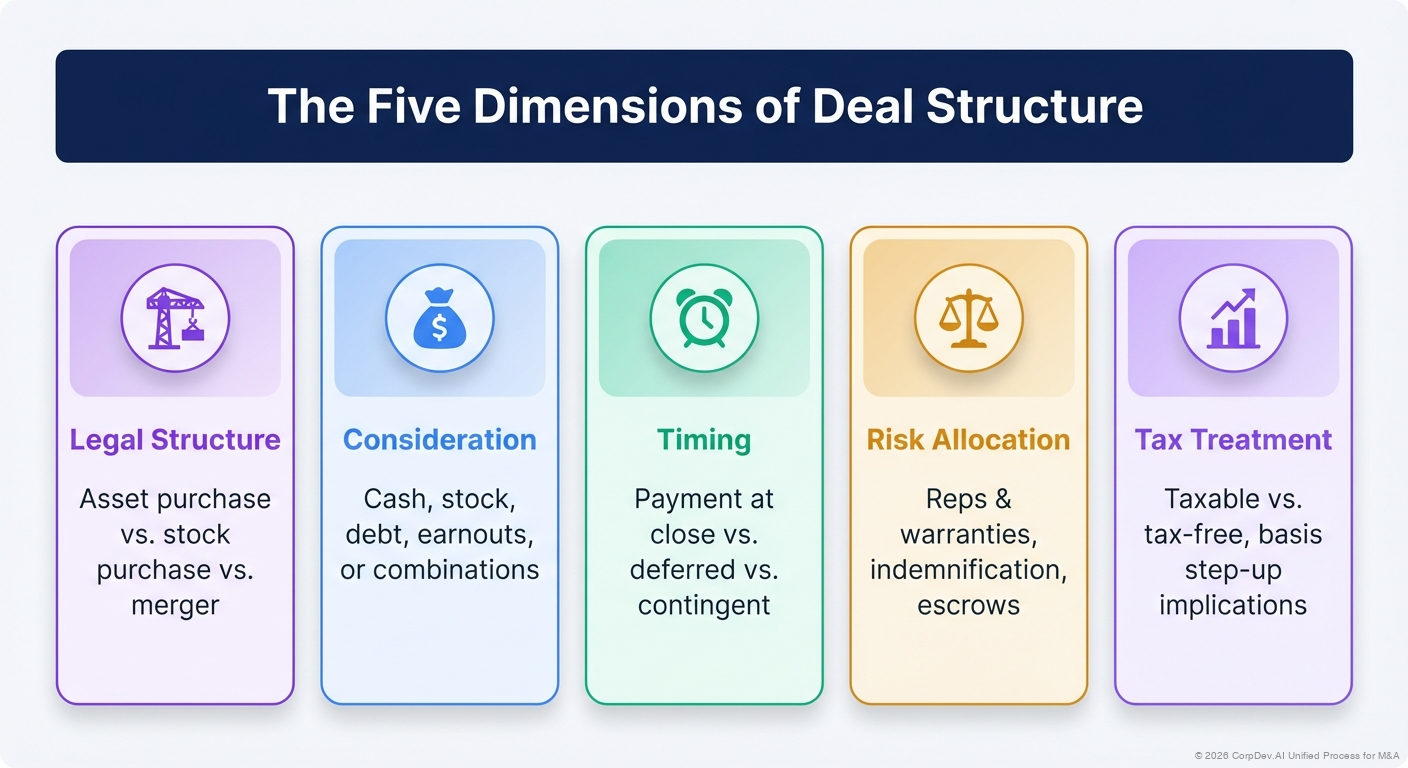

The Five Dimensions of Deal Structure

Legal Structure

Asset purchase vs. stock purchase vs. merger

Consideration

Cash, stock, debt, earnouts, or combinations

Timing

Payment at close vs. deferred vs. contingent

Risk Allocation

Reps & warranties, indemnification, escrows

Tax Treatment

Taxable vs. tax-free, basis step-up implications

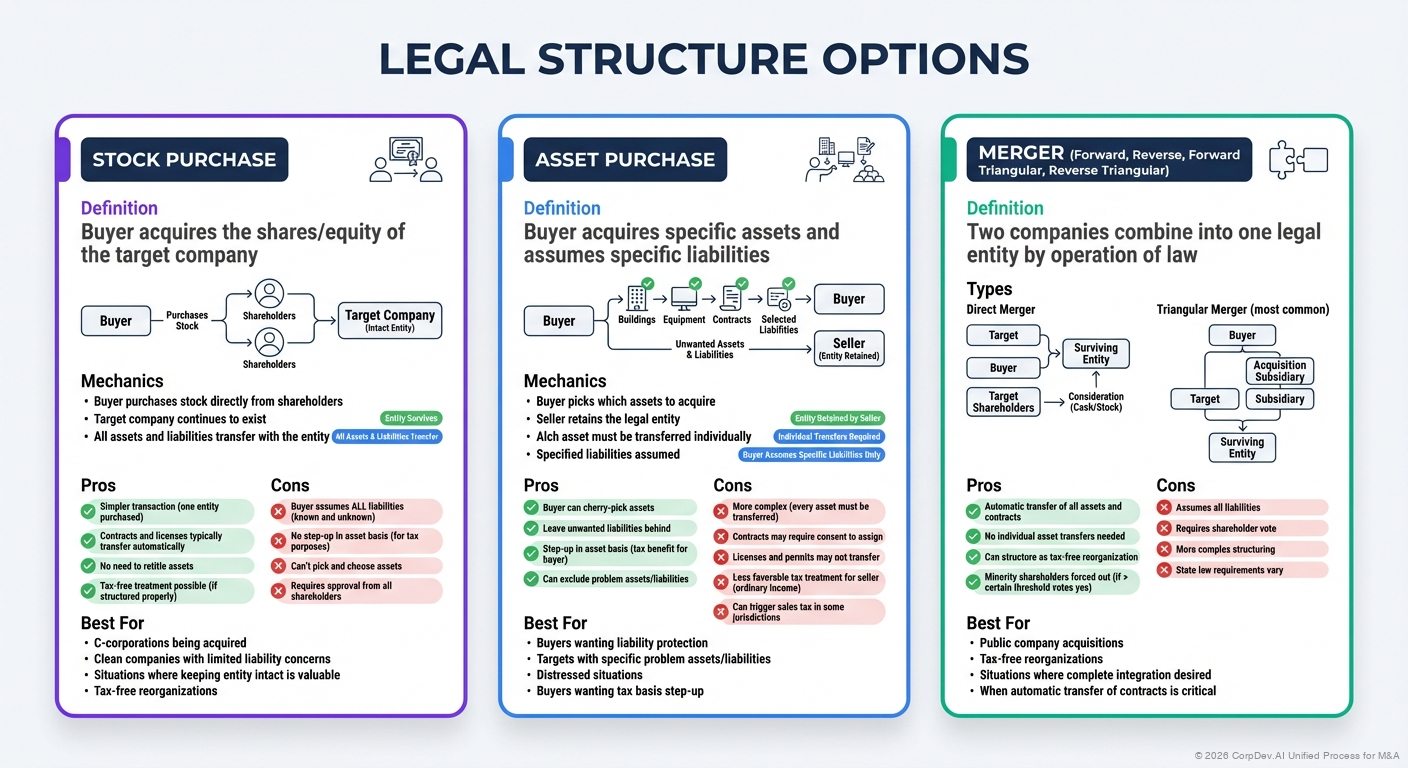

Legal Structure Options

Stock Purchase

Definition: Buyer acquires the shares/equity of the target company

Mechanics:

- Buyer purchases stock directly from shareholders

- Target company continues to exist

- All assets and liabilities transfer with the entity

Pros:

- ✓ Simpler transaction (one entity purchased)

- ✓ Contracts and licenses typically transfer automatically

- ✓ No need to retitle assets

- ✓ Tax-free treatment possible (if structured properly)

Cons:

- ✗ Buyer assumes ALL liabilities (known and unknown)

- ✗ No step-up in asset basis (for tax purposes)

- ✗ Can't pick and choose assets

- ✗ Requires approval from all shareholders

Best For:

- C-corporations being acquired

- Clean companies with limited liability concerns

- Situations where keeping entity intact is valuable

- Tax-free reorganizations

Asset Purchase

Definition: Buyer acquires specific assets and assumes specific liabilities

Mechanics:

- Buyer picks which assets to acquire

- Seller retains the legal entity

- Each asset must be transferred individually

- Specified liabilities assumed

Pros:

- ✓ Buyer can cherry-pick assets

- ✓ Leave unwanted liabilities behind

- ✓ Step-up in asset basis (tax benefit for buyer)

- ✓ Can exclude problem assets/liabilities

Cons:

- ✗ More complex (every asset must be transferred)

- ✗ Contracts may require consent to assign

- ✗ Licenses and permits may not transfer

- ✗ Less favorable tax treatment for seller (ordinary income)

- ✗ Can trigger sales tax in some jurisdictions

Best For:

- Buyers wanting liability protection

- Targets with specific problem assets/liabilities

- Distressed situations

- Buyers wanting tax basis step-up

Merger (Forward, Reverse, Forward Triangular, Reverse Triangular)

Definition: Two companies combine into one legal entity by operation of law

Types:

Direct Merger:

- Target merges into buyer (or vice versa)

- One entity survives, one disappears

- Shareholders of disappearing entity receive consideration

Triangular Merger (most common):

- Buyer creates acquisition subsidiary

- Target merges with/into subsidiary

- Isolates buyer's liabilities

Pros:

- ✓ Automatic transfer of all assets and contracts

- ✓ No individual asset transfers needed

- ✓ Can structure as tax-free reorganization

- ✓ Minority shareholders forced out (if > certain threshold votes yes)

Cons:

- ✗ Assumes all liabilities

- ✗ Requires shareholder vote

- ✗ More complex structuring

- ✗ State law requirements vary

Best For:

- Public company acquisitions

- Tax-free reorganizations

- Situations where complete integration desired

- When automatic transfer of contracts is critical

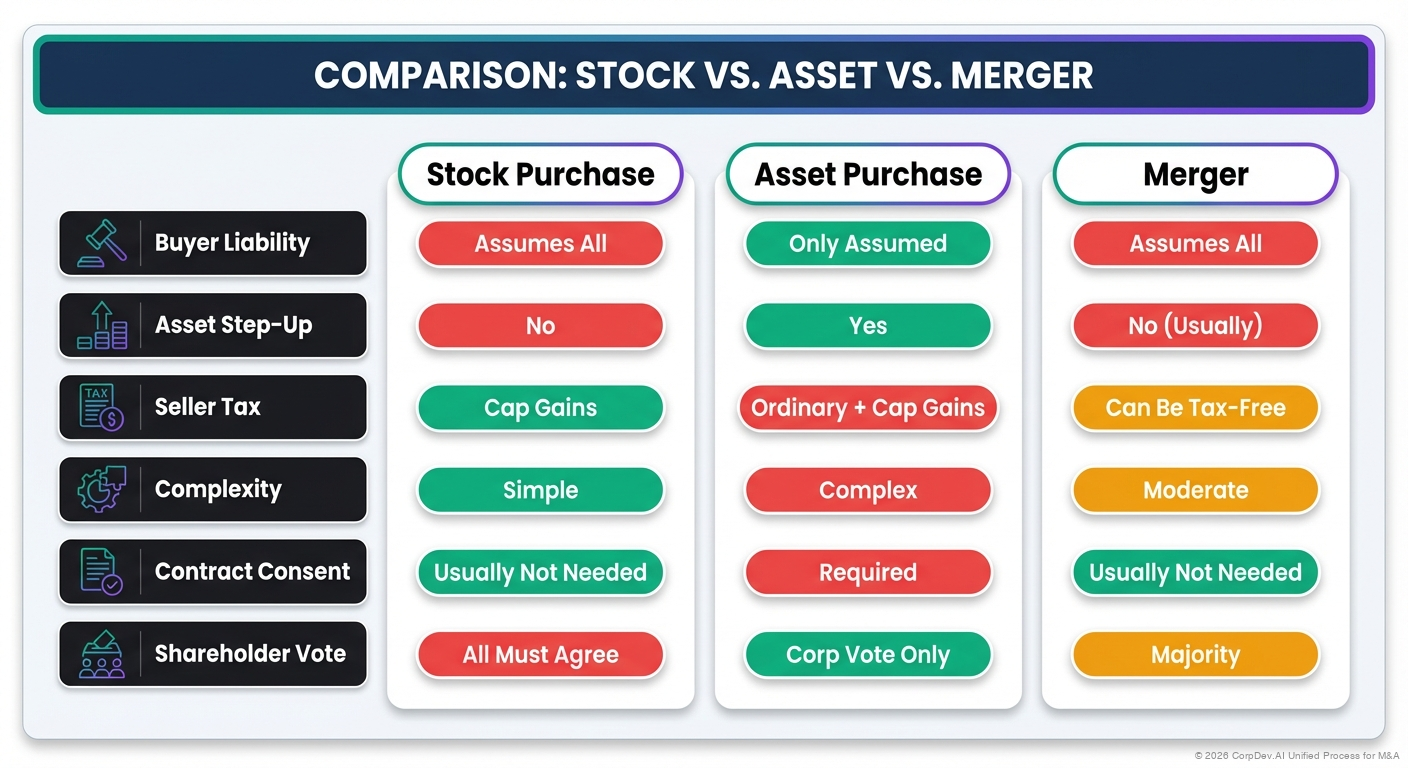

Comparison: Stock vs. Asset vs. Merger

| Factor | Stock Purchase | Asset Purchase | Merger |

|---|---|---|---|

| Buyer Liability | Assumes All | Only Assumed | Assumes All |

| Asset Step-Up | No | Yes | No (Usually) |

| Seller Tax | Cap Gains | Ordinary + Cap Gains | Can Be Tax-Free |

| Complexity | Simple | Complex | Moderate |

| Contract Consent | Usually Not Needed | Required | Usually Not Needed |

| Shareholder Vote | All Must Agree | Corp Vote Only | Majority |

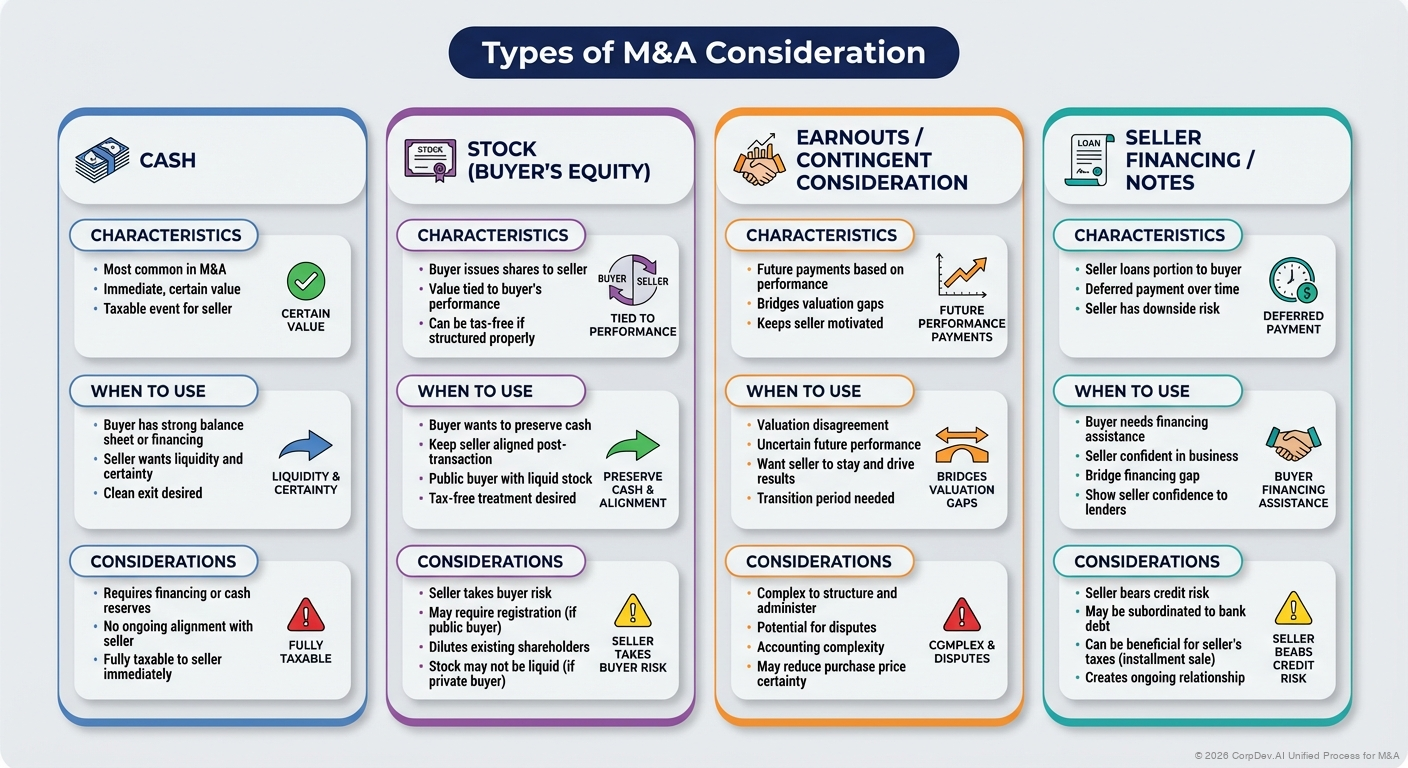

Types of Consideration

Cash

Characteristics:

- Most common in M&A

- Immediate, certain value

- Taxable event for seller

When to Use:

- Buyer has strong balance sheet or financing

- Seller wants liquidity and certainty

- Clean exit desired

Considerations:

- Requires financing or cash reserves

- No ongoing alignment with seller

- Fully taxable to seller immediately

Stock (Buyer's Equity)

Characteristics:

- Buyer issues shares to seller

- Value tied to buyer's performance

- Can be tax-free if structured properly

When to Use:

- Buyer wants to preserve cash

- Keep seller aligned post-transaction

- Public buyer with liquid stock

- Tax-free treatment desired

Considerations:

- Seller takes buyer risk

- May require registration (if public buyer)

- Dilutes existing shareholders

- Stock may not be liquid (if private buyer)

Earnouts / Contingent Consideration

Characteristics:

- Future payments based on performance

- Bridges valuation gaps

- Keeps seller motivated

When to Use:

- Valuation disagreement

- Uncertain future performance

- Want seller to stay and drive results

- Transition period needed

Considerations:

- Complex to structure and administer

- Potential for disputes

- Accounting complexity

- May reduce purchase price certainty

Seller Financing / Notes

Characteristics:

- Seller loans portion to buyer

- Deferred payment over time

- Seller has downside risk

When to Use:

- Buyer needs financing assistance

- Seller confident in business

- Bridge financing gap

- Show seller confidence to lenders

Considerations:

- Seller bears credit risk

- May be subordinated to bank debt

- Can be beneficial for seller's taxes (installment sale)

- Creates ongoing relationship

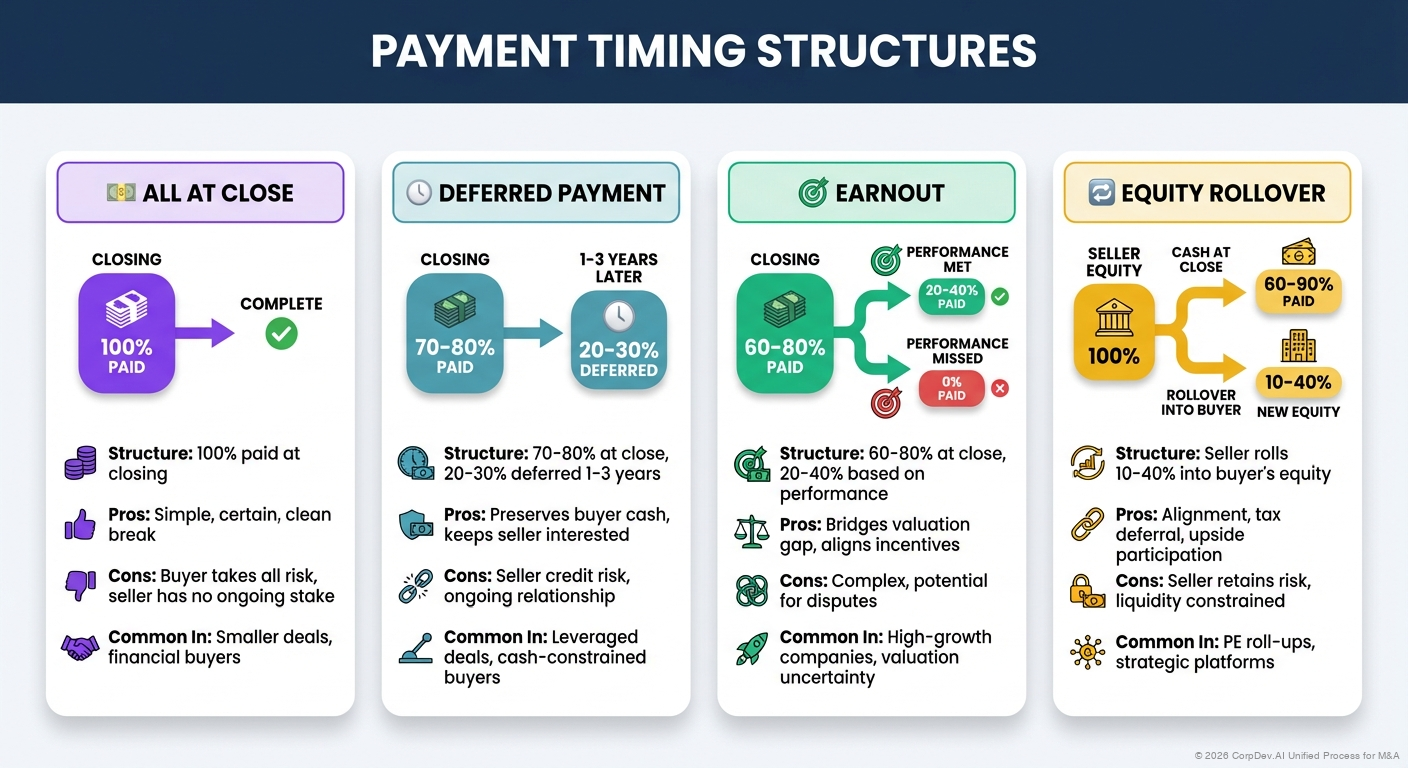

Payment Timing Structures

💵 All at Close

Structure: 100% paid at closing

Pros: Simple, certain, clean break

Cons: Buyer takes all risk, seller has no ongoing stake

Common In: Smaller deals, financial buyers

⏱️ Deferred Payment

Structure: 70-80% at close, 20-30% deferred 1-3 years

Pros: Preserves buyer cash, keeps seller interested

Cons: Seller credit risk, ongoing relationship

Common In: Leveraged deals, cash-constrained buyers

🎯 Earnout

Structure: 60-80% at close, 20-40% based on performance

Pros: Bridges valuation gap, aligns incentives

Cons: Complex, potential for disputes

Common In: High-growth companies, valuation uncertainty

🔄 Equity Rollover

Structure: Seller rolls 10-40% into buyer's equity

Pros: Alignment, tax deferral, upside participation

Cons: Seller retains risk, liquidity constrained

Common In: PE roll-ups, strategic platforms

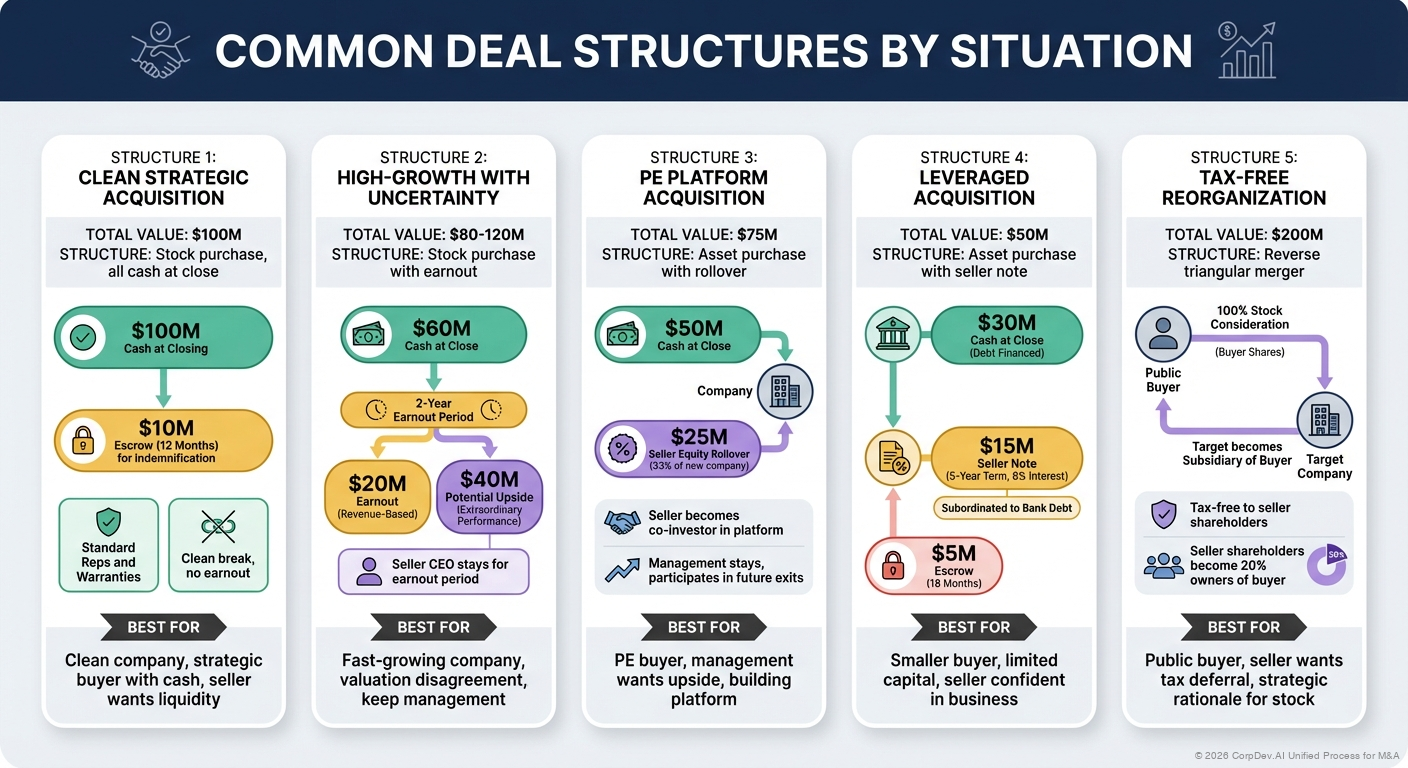

Common Deal Structures by Situation

Structure 1: Clean Strategic Acquisition

Total Value: $100M

Structure: Stock purchase, all cash at close

- $100M cash at closing

- $10M escrow (12 months) for indemnification

- Standard reps and warranties

- Clean break, no earnout

Best For: Clean company, strategic buyer with cash, seller wants liquidity

Structure 2: High-Growth with Uncertainty

Total Value: $80-120M

Structure: Stock purchase with earnout

- $60M cash at close

- $20M earnout over 2 years (revenue-based)

- $40M potential upside if extraordinary performance

- Seller CEO stays for earnout period

Best For: Fast-growing company, valuation disagreement, keep management

Structure 3: PE Platform Acquisition

Total Value: $75M

Structure: Asset purchase with rollover

- $50M cash at close

- $25M seller equity rollover (33% of new company)

- Seller becomes co-investor in platform

- Management stays, participates in future exits

Best For: PE buyer, management wants upside, building platform

Structure 4: Leveraged Acquisition

Total Value: $50M

Structure: Asset purchase with seller note

- $30M cash at close (debt financed)

- $15M seller note (5-year term, 8% interest)

- $5M escrow (18 months)

- Seller note subordinated to bank debt

Best For: Smaller buyer, limited capital, seller confident in business

Structure 5: Tax-Free Reorganization

Total Value: $200M

Structure: Reverse triangular merger

- 100% stock consideration (buyer shares)

- Tax-free to seller shareholders

- Target becomes subsidiary of buyer

- Seller shareholders become 20% owners of buyer

Best For: Public buyer, seller wants tax deferral, strategic rationale for stock

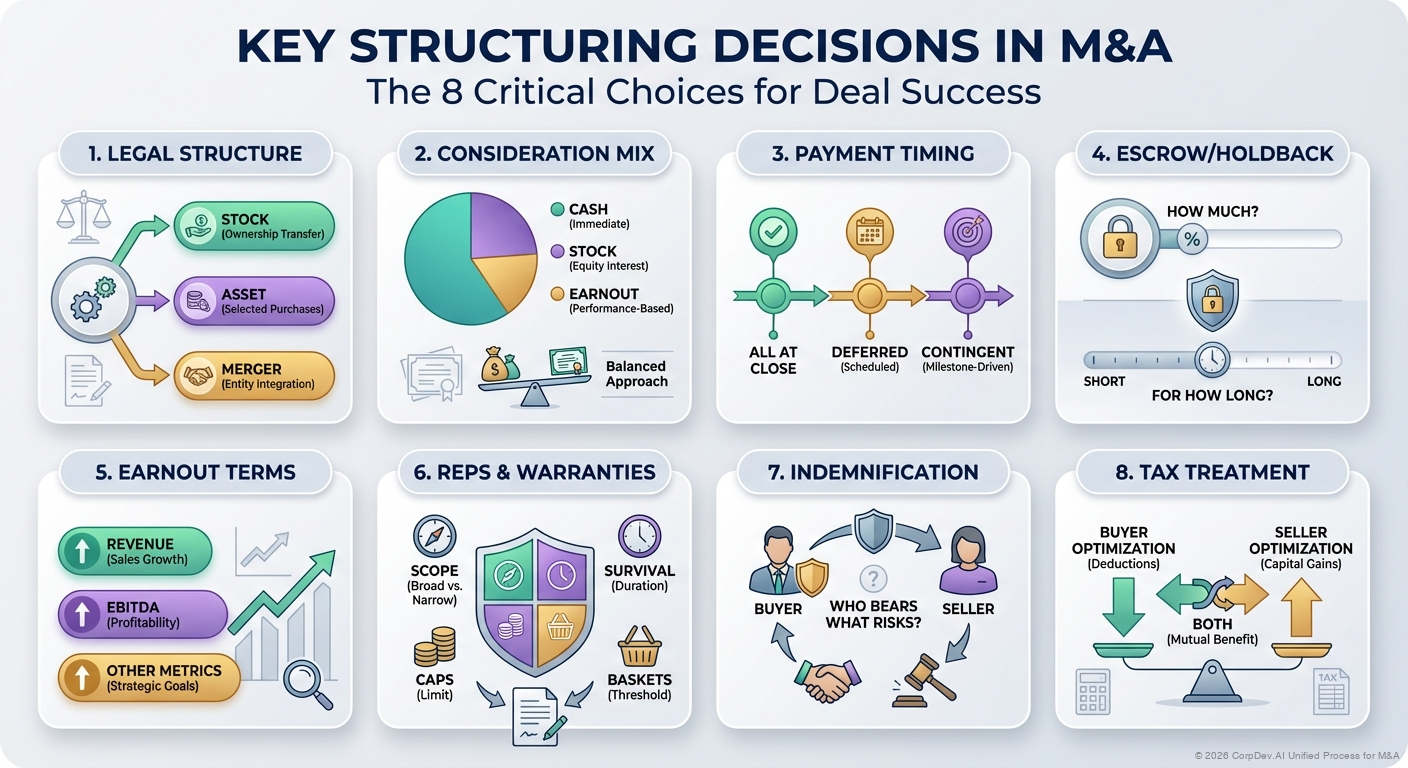

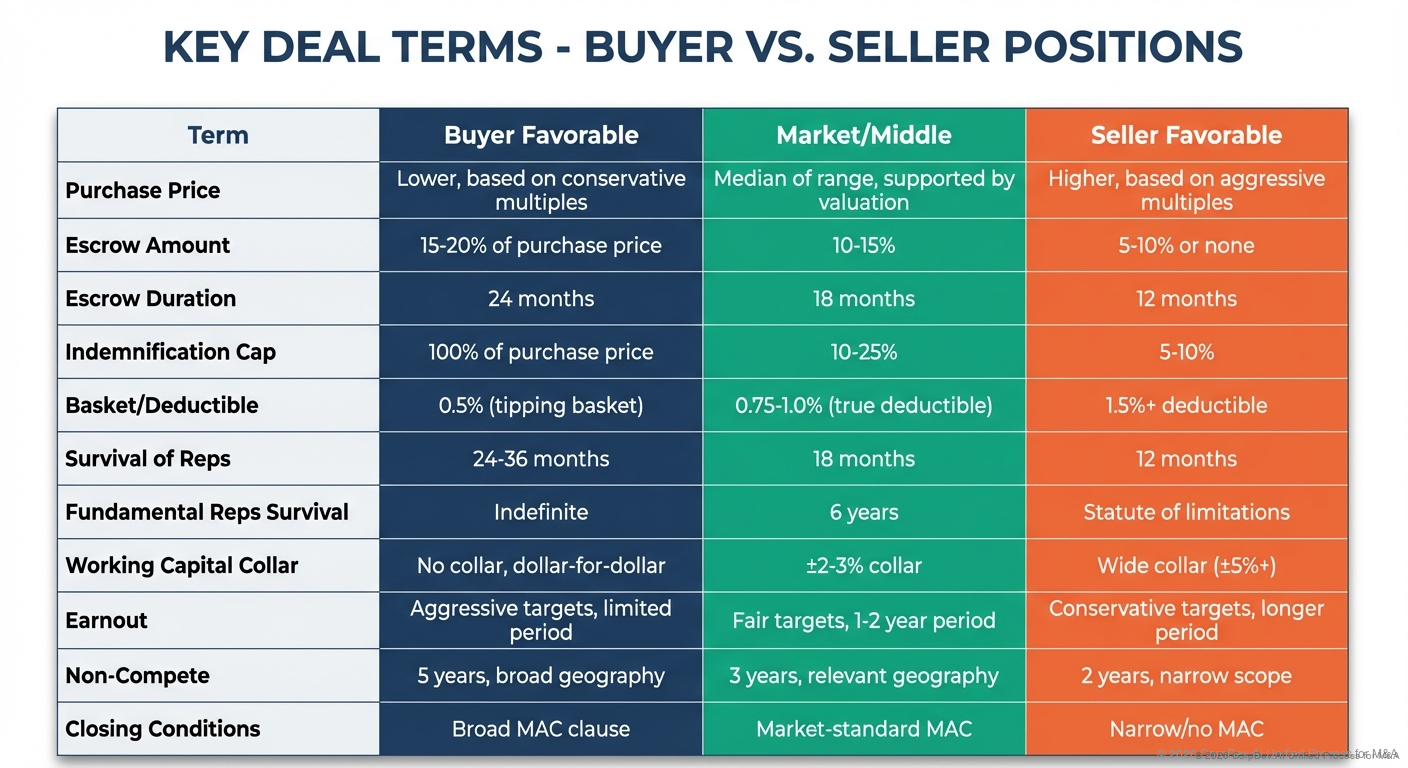

Key Structuring Decisions

The 8 Critical Choices

- Legal Structure: Stock, asset, or merger?

- Consideration Mix: Cash vs. stock vs. earnout?

- Payment Timing: All at close vs. deferred vs. contingent?

- Escrow/Holdback: How much and for how long?

- Earnout Terms: Revenue? EBITDA? Other metrics?

- Reps & Warranties: Scope, survival, caps, and baskets?

- Indemnification: Who bears what risks?

- Tax Treatment: Optimize for buyer? Seller? Both?

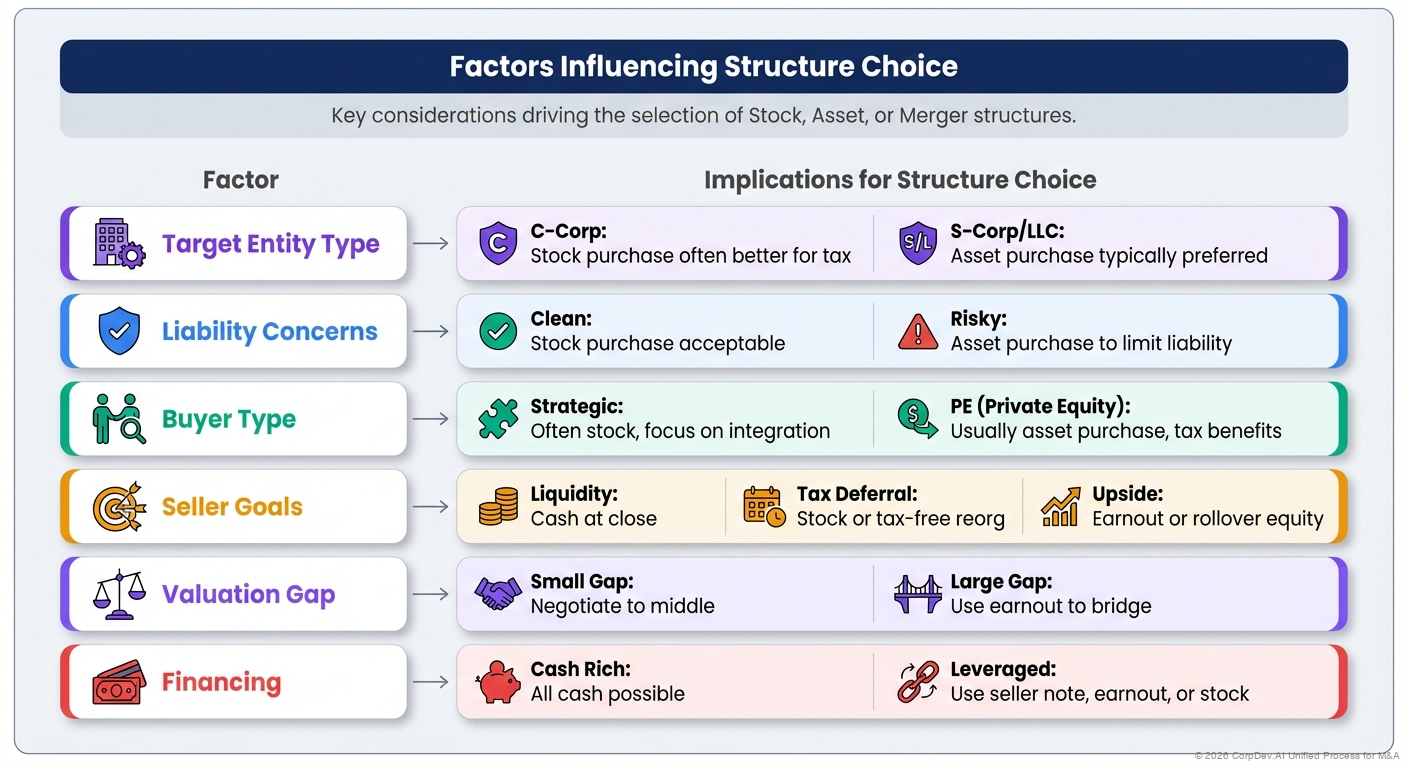

Factors Influencing Structure Choice

| Factor | Implications for Structure |

|---|---|

| Target Entity Type |

C-Corp: Stock purchase often better for tax S-Corp/LLC: Asset purchase typically preferred |

| Liability Concerns |

Clean: Stock purchase acceptable Risky: Asset purchase to limit liability |

| Buyer Type |

Strategic: Often stock, focus on integration PE: Usually asset purchase, tax benefits |

| Seller Goals |

Liquidity: Cash at close Tax Deferral: Stock or tax-free reorg Upside: Earnout or rollover equity |

| Valuation Gap |

Small Gap: Negotiate to middle Large Gap: Use earnout to bridge |

| Financing |

Cash Rich: All cash possible Leveraged: Use seller note, earnout, or stock |

Best Practices in Deal Structuring

1. Start with Tax Analysis

Engage tax advisors early. Tax implications often drive structure more than any other factor.

2. Balance Buyer and Seller Interests

Best deals work for both sides. Don't optimize only for yourself.

3. Keep It Simple When Possible

Complexity creates execution risk and ongoing headaches. Use simple structures unless complexity is necessary.

4. Model Multiple Structures

Run financial analysis on 3-4 different structures. Understand trade-offs.

5. Consider Integration Implications

Some structures (asset purchases) are harder to integrate. Factor this into decision.

6. Document Everything

Clear, written terms prevent disputes. Don't rely on handshakes.

7. Use Market Standards

Unless there's good reason, stick to market-standard terms. Exotic structures slow deals and create risk.

8. Think Through Edge Cases

What happens if seller breaches? If earnout target not met? If business declines? Plan for contingencies.

References

© 2026 CorpDev.Ai Unified Process for M&A

Last updated: Wed Jan 29 2025 19:00:00 GMT-0500 (Eastern Standard Time)