Sourcing Cadence & Pipeline Management

Successful M&A programs don't rely on luck—they build systematic sourcing engines that generate consistent, high-quality deal flow. This requires disciplined cadences for target identification, outreach, relationship building, and pipeline management.

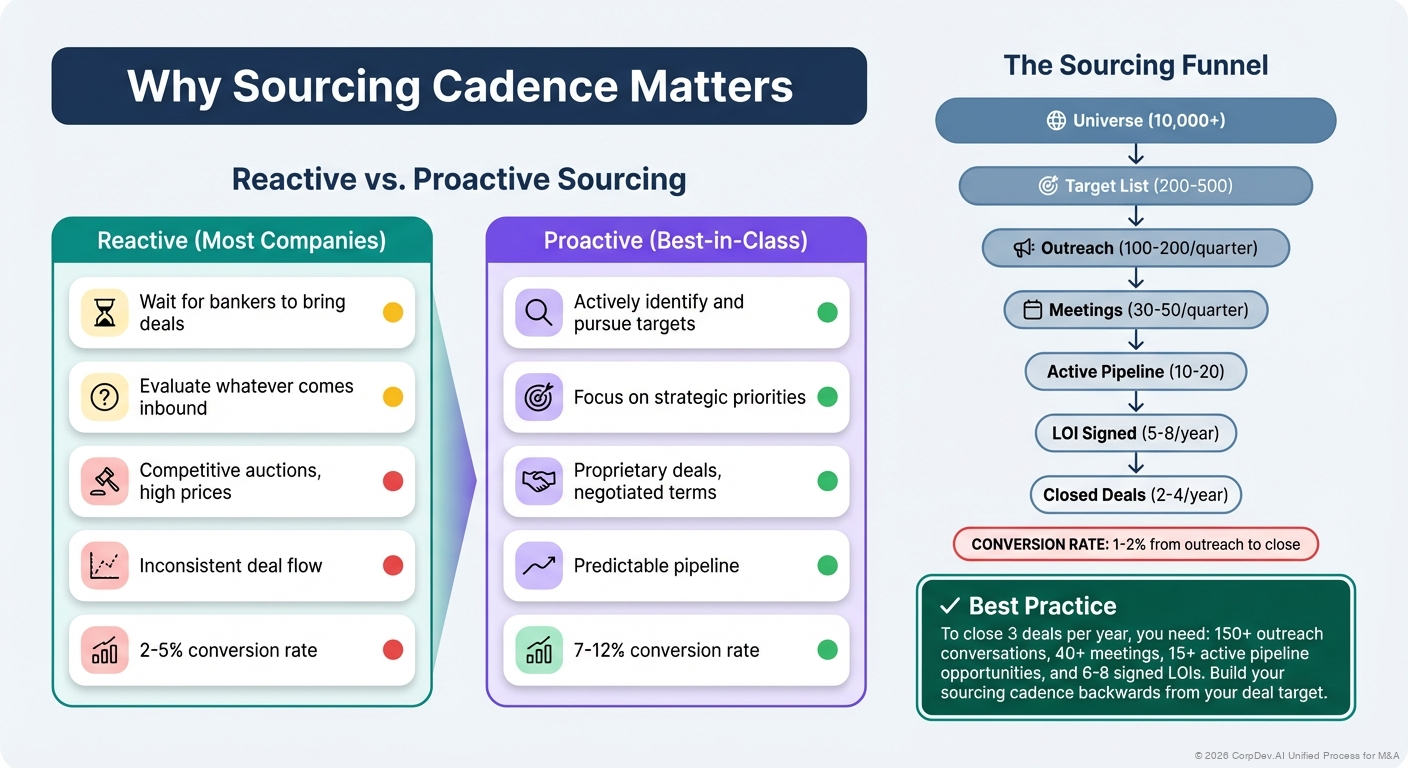

Why Sourcing Cadence Matters

Reactive vs. Proactive Sourcing

| Reactive (Most Companies) | Proactive (Best-in-Class) |

|---|---|

| Wait for bankers to bring deals | Actively identify and pursue targets |

| Evaluate whatever comes inbound | Focus on strategic priorities |

| Competitive auctions, high prices | Proprietary deals, negotiated terms |

| Inconsistent deal flow | Predictable pipeline |

| 2-5% conversion rate | 7-12% conversion rate |

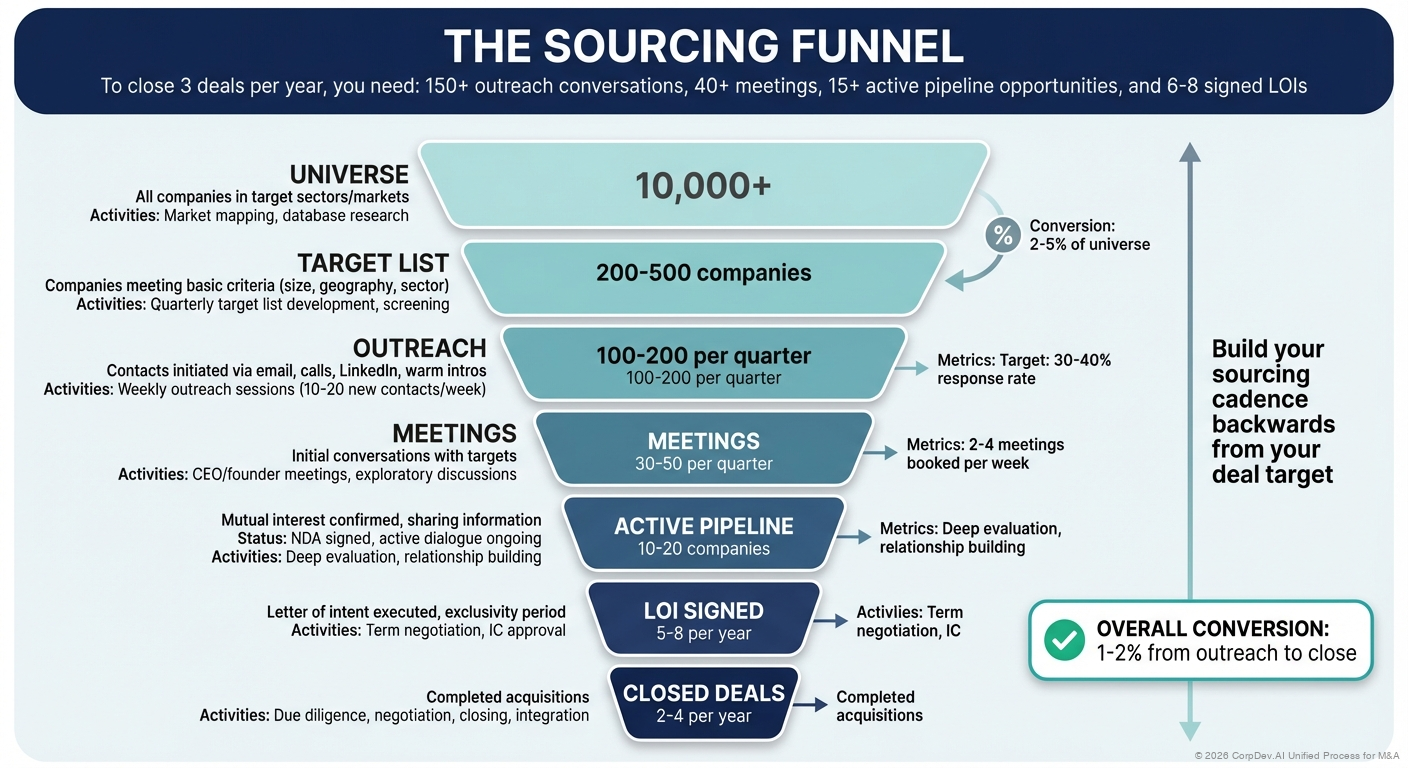

The Sourcing Funnel

Universe (10,000+)

↓

Target List (200-500)

↓

Outreach (100-200/quarter)

↓

Meetings (30-50/quarter)

↓

Active Pipeline (10-20)

↓

LOI Signed (5-8/year)

↓

Closed Deals (2-4/year)

CONVERSION RATE: 1-2% from outreach to close

To close 3 deals per year, you need: 150+ outreach conversations, 40+ meetings, 15+ active pipeline opportunities, and 6-8 signed LOIs. Build your sourcing cadence backwards from your deal target.

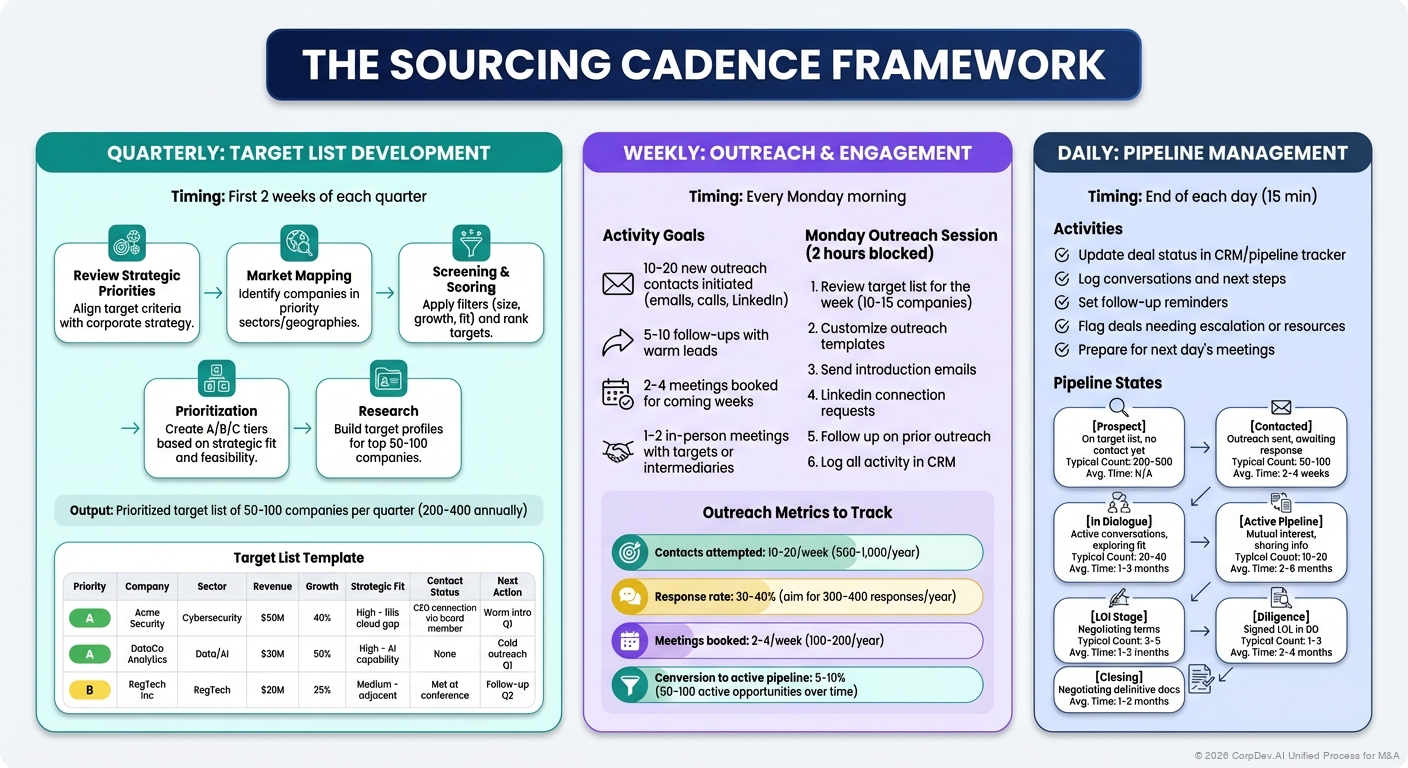

The Sourcing Cadence Framework

Quarterly: Target List Development

Timing: First 2 weeks of each quarter

Process

- Review Strategic Priorities - Align target criteria with corporate strategy

- Market Mapping - Identify companies in priority sectors/geographies

- Screening & Scoring - Apply filters (size, growth, fit) and rank targets

- Prioritization - Create A/B/C tiers based on strategic fit and feasibility

- Research - Build target profiles for top 50-100 companies

Output: Prioritized target list of 50-100 companies per quarter (200-400 annually)

Target List Template

| Priority | Company | Sector | Revenue | Growth | Strategic Fit | Contact Status | Next Action |

|---|---|---|---|---|---|---|---|

| A | Acme Security | Cybersecurity | $50M | 40% | High - fills cloud gap | CEO connection via board member | Warm intro Q1 |

| A | DataCo Analytics | Data/AI | $30M | 50% | High - AI capability | None | Cold outreach Q1 |

| B | RegTech Inc | RegTech | $20M | 25% | Medium - adjacent | Met at conference | Follow-up Q2 |

Weekly: Outreach & Engagement

Timing: Every Monday morning

Activity Goals

- 10-20 new outreach contacts initiated (emails, calls, LinkedIn)

- 5-10 follow-ups with warm leads

- 2-4 meetings booked for coming weeks

- 1-2 in-person meetings with targets or intermediaries

Monday Outreach Session (2 hours blocked)

- Review target list for the week (10-15 companies)

- Customize outreach templates

- Send introduction emails

- LinkedIn connection requests

- Follow up on prior outreach

- Log all activity in CRM

Outreach Metrics to Track

- Contacts attempted: 10-20/week (500-1,000/year)

- Response rate: 30-40% (aim for 300-400 responses/year)

- Meetings booked: 2-4/week (100-200/year)

- Conversion to active pipeline: 5-10% (50-100 active opportunities over time)

Daily: Pipeline Management

Timing: End of each day (15 min)

Activities

- Update deal status in CRM/pipeline tracker

- Log conversations and next steps

- Set follow-up reminders

- Flag deals needing escalation or resources

- Prepare for next day's meetings

Pipeline States

| Stage | Definition | Typical Count | Avg. Time in Stage |

|---|---|---|---|

| Prospect | On target list, no contact yet | 200-500 | N/A |

| Contacted | Outreach sent, awaiting response | 50-100 | 2-4 weeks |

| In Dialogue | Active conversations, exploring fit | 20-40 | 1-3 months |

| Active Pipeline | Mutual interest, sharing info | 10-20 | 2-6 months |

| LOI Stage | Negotiating terms | 3-5 | 1-2 months |

| Diligence | Signed LOI, in DD | 1-3 | 2-4 months |

| Closing | Negotiating definitive docs | 1-2 | 1-2 months |

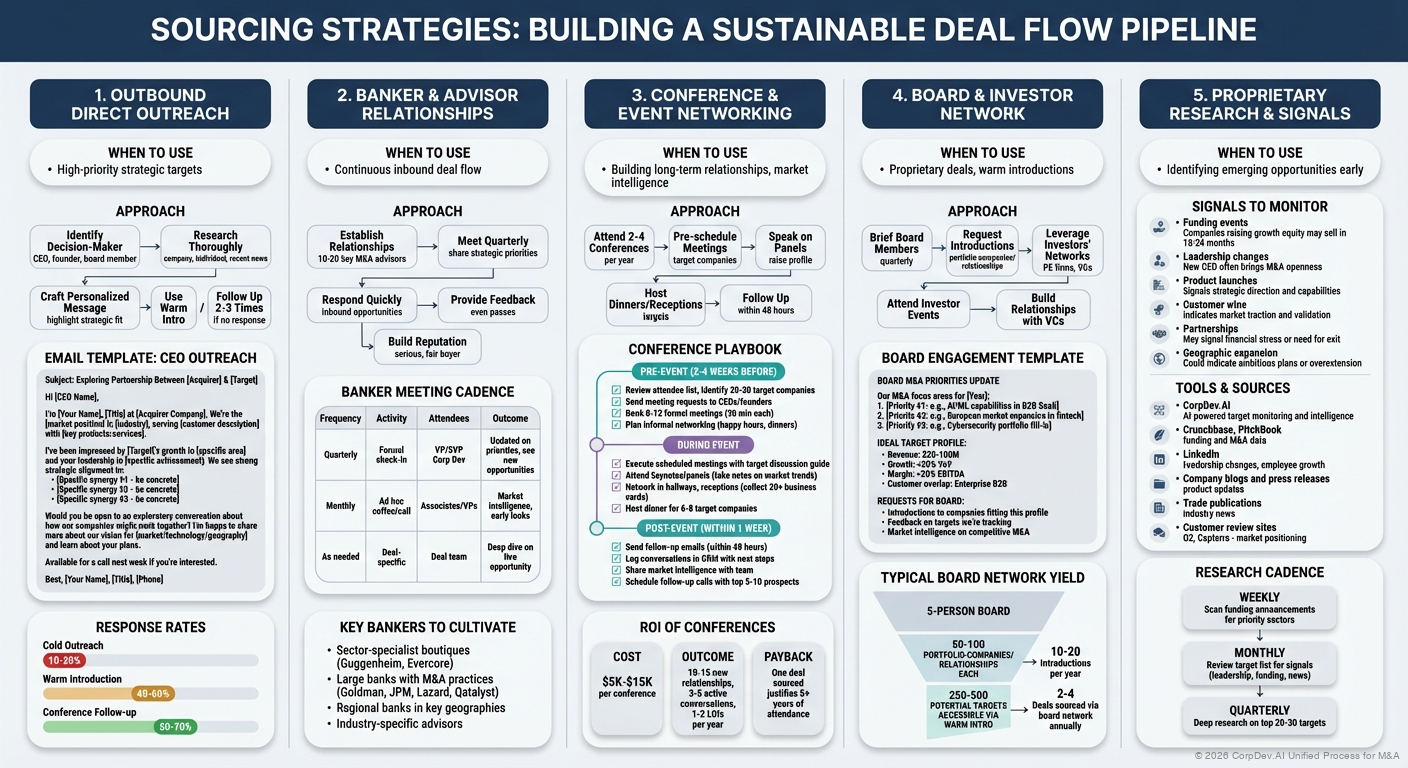

Sourcing Strategies

1. Outbound Direct Outreach

When to Use: High-priority strategic targets

Approach

- Identify decision-maker (CEO, founder, board member)

- Research thoroughly (company, individual, recent news)

- Craft personalized message highlighting strategic fit

- Use warm introduction when possible

- Follow up 2-3 times if no response

Email Template: CEO Outreach

Subject: Exploring Partnership Between [Acquirer] & [Target]

Hi [CEO Name],

I'm [Your Name], [Title] at [Acquirer Company]. We're the [market position]

in [industry], serving [customer description] with [key products/services].

I've been impressed by [Target]'s growth in [specific area] and your

leadership in [specific achievement]. We see strong strategic alignment in:

• [Specific synergy #1 - be concrete]

• [Specific synergy #2 - be concrete]

• [Specific synergy #3 - be concrete]

Would you be open to an exploratory conversation about how our companies

might work together? I'm happy to share more about our vision for [market/

technology/geography] and learn about your plans.

Available for a call next week if you're interested.

Best,

[Your Name]

[Title]

[Phone]

Response Rates

- Cold outreach: 10-20%

- Warm introduction: 40-60%

- Conference follow-up: 50-70%

2. Banker & Advisor Relationships

When to Use: Continuous inbound deal flow

Approach

- Establish relationships with 10-20 key M&A advisors

- Meet quarterly to share strategic priorities

- Respond quickly to inbound opportunities

- Provide feedback on deals (even passes)

- Build reputation as serious, fair buyer

Banker Meeting Cadence

| Frequency | Activity | Attendees | Outcome |

|---|---|---|---|

| Quarterly | Formal check-in | VP/SVP Corp Dev | Updated on priorities, see new opportunities |

| Monthly | Ad hoc coffee/call | Associates/VPs | Market intelligence, early looks |

| As needed | Deal-specific | Deal team | Deep dive on live opportunity |

Key Bankers to Cultivate

- Sector-specialist boutiques (e.g., Guggenheim for tech, Evercore for healthcare)

- Large banks with M&A practices (Goldman, JPM, Lazard, Qatalyst)

- Regional banks in key geographies

- Industry-specific advisors

3. Conference & Event Networking

When to Use: Building long-term relationships, market intelligence

Approach

- Attend 2-4 industry conferences per year

- Pre-schedule meetings with target companies

- Speak on panels to raise profile

- Host dinners or receptions for targets

- Follow up within 48 hours post-event

Conference Playbook

Pre-Event (2-4 weeks before)

- Review attendee list, identify 20-30 target companies

- Send meeting requests to CEOs/founders

- Book 8-12 formal meetings (30 min each)

- Plan informal networking (happy hours, dinners)

During Event

- Execute scheduled meetings with target discussion guide

- Attend keynotes and panels (take notes on market trends)

- Network in hallways, receptions (collect 20+ business cards)

- Host dinner for 6-8 target companies

Post-Event (within 1 week)

- Send follow-up emails to all contacts within 48 hours

- Log all conversations in CRM with next steps

- Share market intelligence with team

- Schedule follow-up calls with top 5-10 prospects

ROI of Conferences

- Cost: $5K-$15K per conference (travel, tickets, dinners)

- Outcome: 10-15 new relationships, 3-5 active conversations, 1-2 LOIs per year

- Payback: One deal sourced from conferences justifies 5+ years of attendance

4. Board & Investor Network

When to Use: Proprietary deals, warm introductions

Approach

- Brief board members on M&A priorities quarterly

- Request introductions to portfolio companies or relationships

- Leverage investors' networks (PE firms, VCs)

- Attend investor events and conferences

- Build relationships with VCs in target sectors

Board Engagement Template

BOARD M&A PRIORITIES UPDATE

Our M&A focus areas for [Year]:

1. [Priority #1: e.g., AI/ML capabilities in B2B SaaS]

2. [Priority #2: e.g., European market expansion in fintech]

3. [Priority #3: e.g., Cybersecurity portfolio fill-in]

IDEAL TARGET PROFILE:

• Revenue: $20-100M

• Growth: >30% YoY

• Margin: >20% EBITDA

• Customer overlap: Enterprise B2B

REQUESTS FOR BOARD:

• Introductions to companies fitting this profile

• Feedback on targets we're tracking

• Market intelligence on competitive M&A

Typical Board Network Yield

- 5-person board → 50-100 portfolio companies/relationships each

- 250-500 potential targets accessible via warm intro

- 10-20 introductions per year

- 2-4 deals sourced via board network annually

5. Proprietary Research & Signals

When to Use: Identifying emerging opportunities early

Signals to Monitor

- Funding events - Companies raising growth equity may sell in 18-24 months

- Leadership changes - New CEO often brings M&A openness

- Product launches - Signals strategic direction and capabilities

- Customer wins - Indicates market traction and validation

- Partnerships - May signal financial stress or need for exit

- Geographic expansion - Could indicate ambitious plans or overextension

Tools & Sources

- CorpDev.Ai (AI-powered target monitoring and intelligence)

- Crunchbase, PitchBook (funding and M&A data)

- LinkedIn (leadership changes, employee growth)

- Company blogs and press releases (product updates)

- Trade publications (industry news)

- Customer review sites (G2, Capterra - market positioning)

Research Cadence

- Weekly: Scan funding announcements for priority sectors

- Monthly: Review target list for signals (leadership, funding, news)

- Quarterly: Deep research on top 20-30 targets

Pipeline Management Best Practices

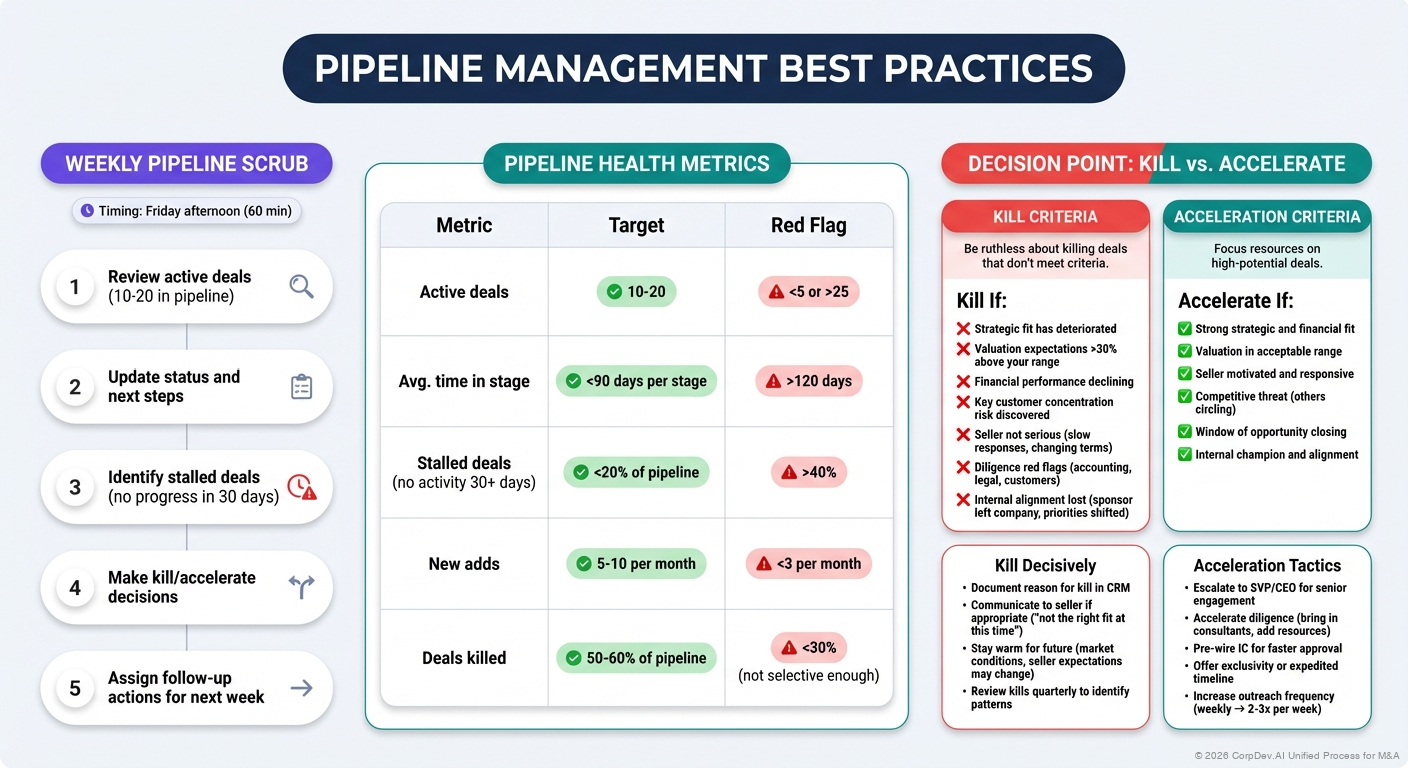

Weekly Pipeline Scrub

Timing: Friday afternoon (60 min)

Process

- Review all active deals (10-20 in pipeline)

- Update status and next steps

- Identify stalled deals (no progress in 30 days)

- Make kill/accelerate decisions

- Assign follow-up actions for next week

Pipeline Health Metrics

| Metric | Target | Red Flag |

|---|---|---|

| Active deals | 10-20 | <5 or >25 |

| Avg. time in stage | <90 days per stage | >120 days |

| Stalled deals (no activity 30+ days) | <20% of pipeline | >40% |

| New adds | 5-10 per month | <3 per month |

| Deals killed | 50-60% of pipeline | <30% (not selective enough) |

Kill Criteria

Be ruthless about killing deals that don't meet criteria:

Kill If:

- ❌ Strategic fit has deteriorated

- ❌ Valuation expectations >30% above your range

- ❌ Financial performance declining

- ❌ Key customer concentration risk discovered

- ❌ Seller not serious (slow responses, changing terms)

- ❌ Diligence red flags (accounting, legal, customers)

- ❌ Internal alignment lost (sponsor left company, priorities shifted)

Kill Decisively

- Document reason for kill in CRM

- Communicate to seller if appropriate ("not the right fit at this time")

- Stay warm for future (market conditions, seller expectations may change)

- Review kills quarterly to identify patterns

Acceleration Criteria

Accelerate If:

- ✅ Strong strategic and financial fit

- ✅ Valuation in acceptable range

- ✅ Seller motivated and responsive

- ✅ Competitive threat (others circling)

- ✅ Window of opportunity closing

- ✅ Internal champion and alignment

Acceleration Tactics

- Escalate to SVP/CEO for senior engagement

- Accelerate diligence (bring in consultants, add resources)

- Pre-wire IC for faster approval

- Offer exclusivity or expedited timeline

- Increase outreach frequency (weekly → 2-3x per week)

CRM & Pipeline Tracking

![]()

Pipeline Tracker Requirements

Must-Have Fields

- Company name, sector, geography

- Revenue, EBITDA, growth rate

- Contact information (CEO, CFO, banker)

- Stage in pipeline

- Last contact date and next action

- Strategic fit score (1-5)

- Valuation expectations vs. range

- Key deal champion (internal)

- Notes/history log

Sample Pipeline Tracker

| Company | Sector | Rev ($M) | Stage | Last Contact | Next Action | Fit | Val. Gap | Owner |

|---|---|---|---|---|---|---|---|---|

| Acme Security | Cyber | $50M | Active Pipeline | 10/15 | Send NDA, schedule mgmt call | 5 | -10% | Jane |

| DataCo | AI/Data | $30M | LOI | 10/20 | Finalize price, submit to IC | 5 | +15% | John |

| RegTech | RegTech | $20M | In Dialogue | 9/30 | Follow up on Q3 results | 3 | +30% | Jane |

| CloudOps | DevOps | $40M | Contacted | 10/1 | Awaiting response | 4 | TBD | John |

CRM Platforms for M&A

Spreadsheet-Based (for small teams 1-2 FTE)

- Pros: Free, simple, customizable

- Cons: No automation, no collaboration features, manual updates

- Best for: <50 active targets, simple workflows

Dedicated M&A CRM (for mid-sized teams 3-5 FTE)

- Options: CorpDev.Ai, DealCloud, Affinity, SourceScrub

- Pros: M&A-specific features, relationship mapping, automation

- Cons: $25K-$100K annually (traditional tools), implementation effort

- Best for: >100 active targets, multiple team members, complex workflows

General CRM Adapted (for teams with existing CRM)

- Options: Salesforce, HubSpot (customized for M&A)

- Pros: Leverage existing platform, integrated with other tools

- Cons: Requires customization, not M&A-optimized

- Best for: Companies with enterprise CRM already deployed

Sourcing Metrics & KPIs

Leading Indicators (Activities)

| Metric | Weekly Target | Quarterly Target |

|---|---|---|

| Outreach sent | 10-20 | 120-240 |

| Responses received | 5-10 | 60-120 |

| Meetings booked | 2-4 | 24-48 |

| Meetings held | 2-4 | 24-48 |

| New pipeline adds | 1-2 | 12-24 |

Lagging Indicators (Outcomes)

| Metric | Quarterly Target | Annual Target |

|---|---|---|

| Active pipeline | 10-20 | 10-20 |

| LOIs signed | 1-2 | 4-8 |

| Deals closed | 0-1 | 2-4 |

| Total deal value | - | $200M-$1B |

Conversion Metrics

| Conversion | Target Rate | Benchmark |

|---|---|---|

| Outreach → Response | 30-40% | 25-35% median |

| Response → Meeting | 50-60% | 40-50% median |

| Meeting → Active Pipeline | 20-30% | 15-25% median |

| Active → LOI | 30-40% | 25-35% median |

| LOI → Close | 50-60% | 40-50% median |

| Outreach → Close | 1-2% | 0.5-1.5% median |

Don't focus on activity metrics alone (emails sent, meetings held). Track conversion rates and deal outcomes. 100 meetings with low-fit targets is worse than 20 meetings with perfect-fit targets.

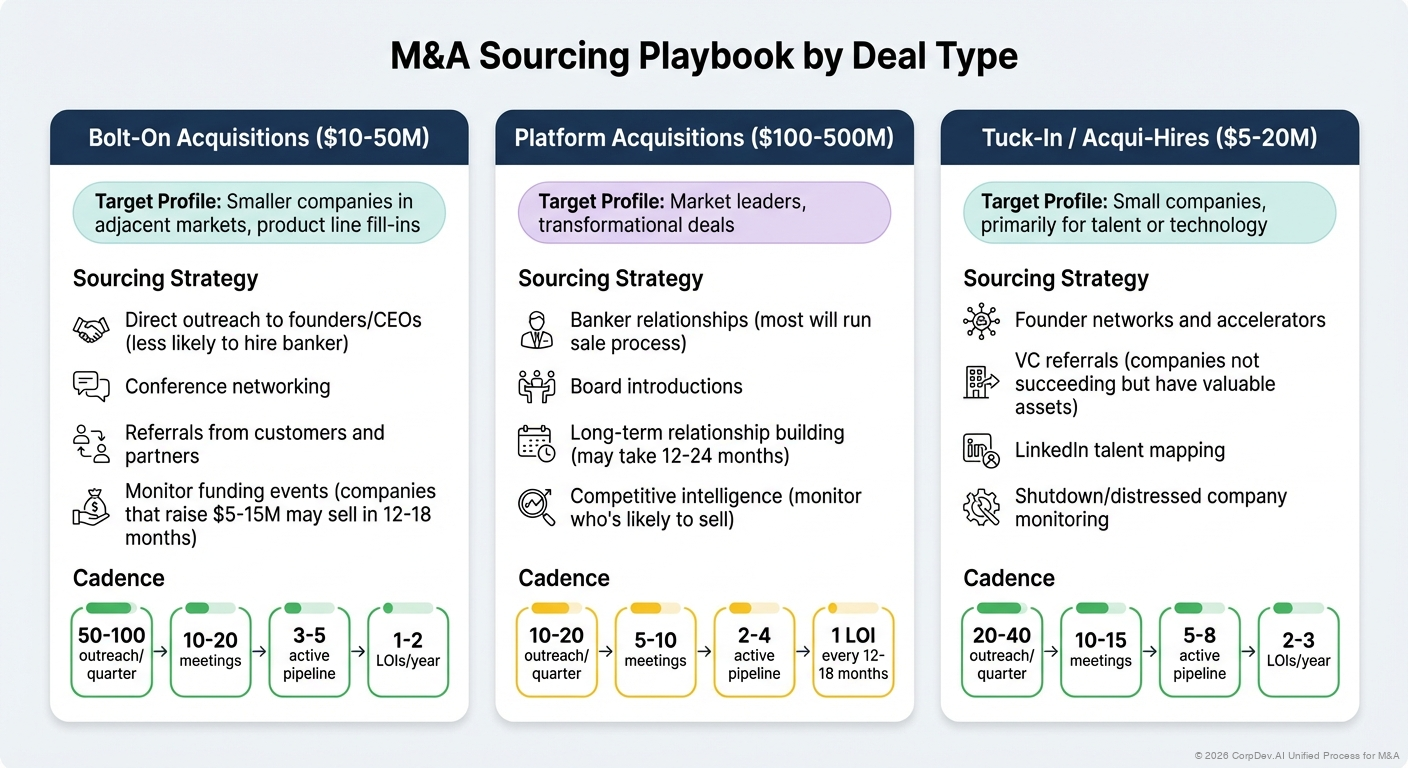

Sourcing Playbook by Deal Type

Bolt-On Acquisitions ($10-50M)

Target Profile: Smaller companies in adjacent markets, product line fill-ins

Sourcing Strategy

- Direct outreach to founders/CEOs (less likely to hire banker)

- Conference networking

- Referrals from customers and partners

- Monitor funding events (companies that raise $5-15M may sell in 12-18 months)

Cadence: 50-100 outreach/quarter → 10-20 meetings → 3-5 active pipeline → 1-2 LOIs/year

Platform Acquisitions ($100-500M)

Target Profile: Market leaders, transformational deals

Sourcing Strategy

- Banker relationships (most will run sale process)

- Board introductions

- Long-term relationship building (may take 12-24 months)

- Competitive intelligence (monitor who's likely to sell)

Cadence: 10-20 outreach/quarter → 5-10 meetings → 2-4 active pipeline → 1 LOI every 12-18 months

Tuck-In / Acqui-Hires ($5-20M)

Target Profile: Small companies, primarily for talent or technology

Sourcing Strategy

- Founder networks and accelerators

- VC referrals (companies not succeeding but have valuable assets)

- LinkedIn talent mapping

- Shutdown/distressed company monitoring

Cadence: 20-40 outreach/quarter → 10-15 meetings → 5-8 active → 2-3 LOIs/year

Sourcing Cadence Template

Sample Quarter Plan

Q1 Sourcing Goals

- Develop target list: 100 companies (40 A-tier, 40 B-tier, 20 C-tier)

- Outreach: 150 new contacts

- Meetings: 30 initial conversations

- Pipeline adds: 10 new active opportunities

- LOIs: 1-2 signed

Weekly Schedule

| Day | Activity | Time | Outcome |

|---|---|---|---|

| Monday AM | Outreach blitz | 2 hours | 10-15 emails sent, 5-10 LinkedIn connects |

| Monday PM | Prepare for week's meetings | 1 hour | Agendas, research, materials ready |

| Tue-Thu | Target meetings | 4-6 hours | 3-5 meetings with targets or bankers |

| Friday AM | Follow-ups | 1 hour | Thank-yous, next steps, meeting requests |

| Friday PM | Pipeline scrub | 1 hour | Update CRM, kill/accelerate decisions |

Monthly Reviews

- Week 1: Target list refresh, add 10-20 new companies

- Week 2: Pipeline health review with VP/SVP, kill stalled deals

- Week 3: Banker meetings (2-3 check-ins)

- Week 4: Month-end reporting, plan next month

Common Sourcing Mistakes

❌ Mistake 1: No Systematic Outreach

Problem: Waiting for deals to come to you

Solution: Block 2 hours every Monday for outreach, track activity metrics

❌ Mistake 2: Spray-and-Pray

Problem: Mass emailing 1,000 companies with generic message

Solution: Target top 100, personalize each message, focus on quality over quantity

❌ Mistake 3: Not Killing Fast Enough

Problem: Pipeline clogged with 30+ low-probability deals

Solution: Weekly scrub, kill 50-60% of opportunities, keep only best fits

❌ Mistake 4: Ignoring Conversion Metrics

Problem: Lots of activity but no deals

Solution: Track conversion rates at each stage, optimize bottlenecks

❌ Mistake 5: One-and-Done Follow-Up

Problem: Send one email, give up if no response

Solution: Follow up 2-3 times over 4-6 weeks, try different channels (email, LinkedIn, phone)

Key Takeaways

- Systematic sourcing beats reactive - weekly cadence generates 10x more deal flow than waiting for bankers

- Funnel math is predictable - 150 outreach → 30 meetings → 10 pipeline → 2 LOIs → 1 close

- Quality over quantity - 20 meetings with perfect-fit targets > 100 meetings with mediocre fits

- Kill ruthlessly - keep only 10-20 active deals, accelerate or kill the rest

- Track conversion rates - identify bottlenecks (low response rate? poor meeting→pipeline conversion?)

- Leverage multiple channels - direct outreach, bankers, conferences, board network

- CRM is critical - can't manage 100+ targets in your head, need system

- Be patient - average time from first contact to close is 12-18 months for large deals

Sourcing is a numbers game with a long sales cycle. Consistency matters more than intensity. Two hours of outreach every Monday for a year generates more deals than a one-month push followed by months of inactivity.

Related Resources

- M&A Operations Overview - Operating systems for corp dev functions

- Meeting Cadence & Governance - Weekly/monthly meeting rhythms

- Reporting & Metrics - Dashboards and KPIs for sourcing

- Building an M&A Pipeline - Pipeline development strategies

- Target Identification & Sourcing - Detailed target sourcing process

© 2026 CorpDev.Ai Unified Process for M&A

Last updated: Thu Oct 30 2025 20:00:00 GMT-0400 (Eastern Daylight Time)