M&A Process Overview

The M&A process is a structured sequence of activities that takes a transaction from initial strategy through post-merger integration. Understanding this lifecycle is critical for corporate development professionals to execute successful deals.

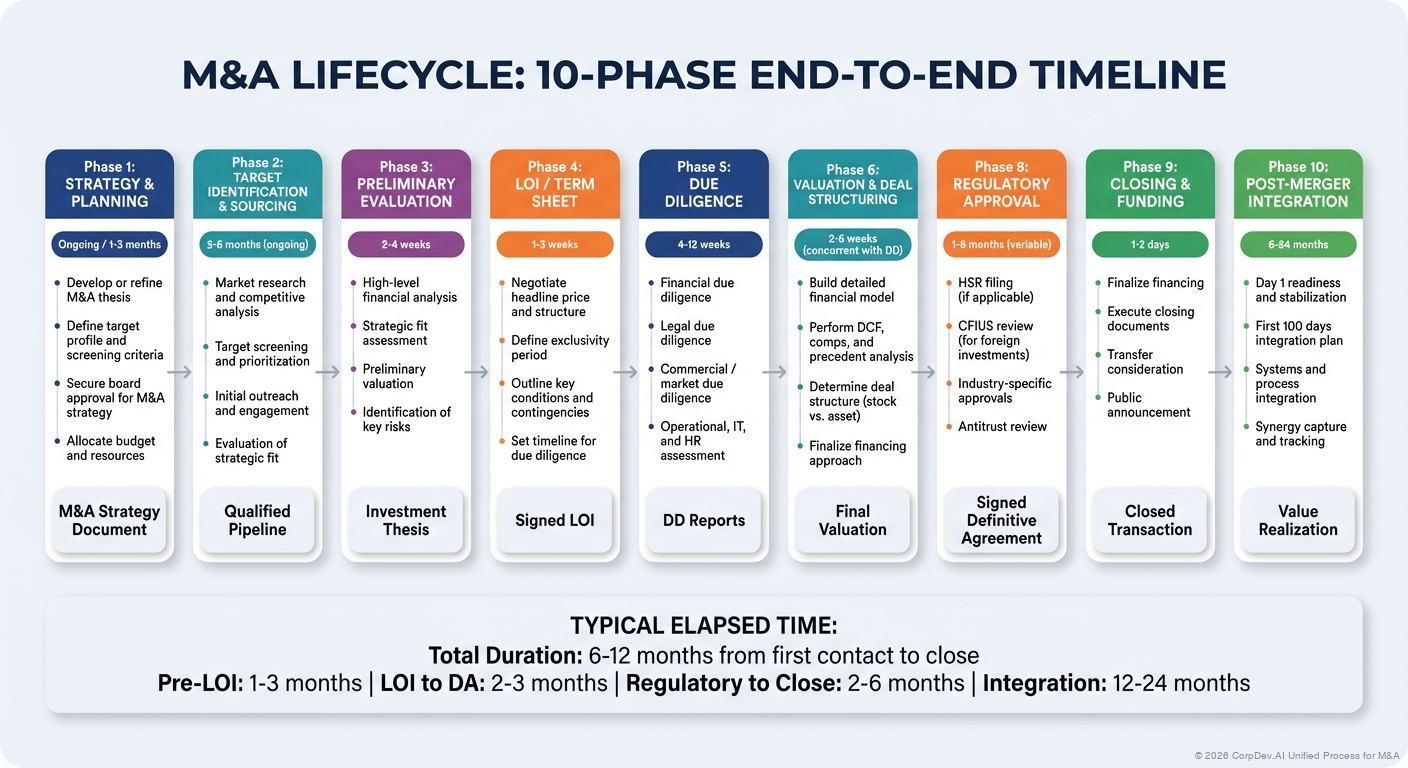

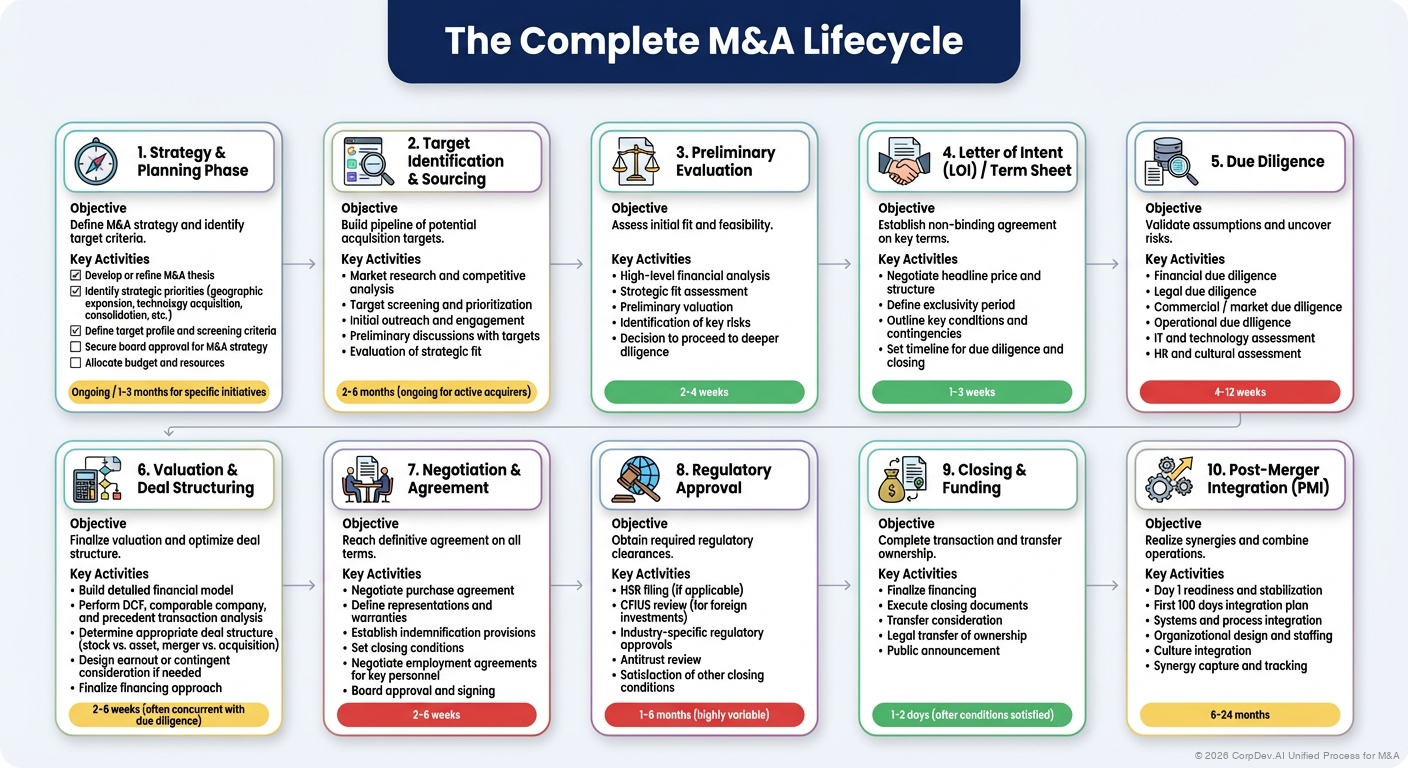

The Complete M&A Lifecycle

A typical M&A transaction progresses through several distinct phases:

1. Strategy & Planning Phase

Objective: Define M&A strategy and identify target criteria

Key Activities:

- Develop or refine M&A thesis

- Identify strategic priorities (geographic expansion, technology acquisition, consolidation, etc.)

- Define target profile and screening criteria

- Secure board approval for M&A strategy

- Allocate budget and resources

Timeline: Ongoing / 1-3 months for specific initiatives

2. Target Identification & Sourcing

Objective: Build pipeline of potential acquisition targets

Key Activities:

- Market research and competitive analysis

- Target screening and prioritization

- Initial outreach and engagement

- Preliminary discussions with targets

- Evaluation of strategic fit

Timeline: 2-6 months (ongoing for active acquirers)

3. Preliminary Evaluation

Objective: Assess initial fit and feasibility

Key Activities:

- High-level financial analysis

- Strategic fit assessment

- Preliminary valuation

- Identification of key risks

- Decision to proceed to deeper diligence

Timeline: 2-4 weeks

4. Letter of Intent (LOI) / Term Sheet

Objective: Establish non-binding agreement on key terms

Key Activities:

- Negotiate headline price and structure

- Define exclusivity period

- Outline key conditions and contingencies

- Set timeline for due diligence and closing

Timeline: 1-3 weeks

5. Due Diligence

Objective: Validate assumptions and uncover risks

Key Activities:

- Financial due diligence

- Legal due diligence

- Commercial / market due diligence

- Operational due diligence

- IT and technology assessment

- HR and cultural assessment

Timeline: 4-12 weeks

6. Valuation & Deal Structuring

Objective: Finalize valuation and optimize deal structure

Key Activities:

- Build detailed financial model

- Perform DCF, comparable company, and precedent transaction analysis

- Determine appropriate deal structure (stock vs. asset, merger vs. acquisition)

- Design earnout or contingent consideration if needed

- Finalize financing approach

Timeline: 2-6 weeks (often concurrent with due diligence)

7. Negotiation & Agreement

Objective: Reach definitive agreement on all terms

Key Activities:

- Negotiate purchase agreement

- Define representations and warranties

- Establish indemnification provisions

- Set closing conditions

- Negotiate employment agreements for key personnel

- Board approval and signing

Timeline: 2-6 weeks

8. Regulatory Approval

Objective: Obtain required regulatory clearances

Key Activities:

- HSR filing (if applicable)

- CFIUS review (for foreign investments)

- Industry-specific regulatory approvals

- Antitrust review

- Satisfaction of other closing conditions

Timeline: 1-6 months (highly variable)

9. Closing & Funding

Objective: Complete transaction and transfer ownership

Key Activities:

- Finalize financing

- Execute closing documents

- Transfer consideration

- Legal transfer of ownership

- Public announcement

Timeline: 1-2 days (after conditions satisfied)

10. Post-Merger Integration (PMI)

Objective: Realize synergies and combine operations

Key Activities:

- Day 1 readiness and stabilization

- First 100 days integration plan

- Systems and process integration

- Organizational design and staffing

- Culture integration

- Synergy capture and tracking

Timeline: 6-24 months

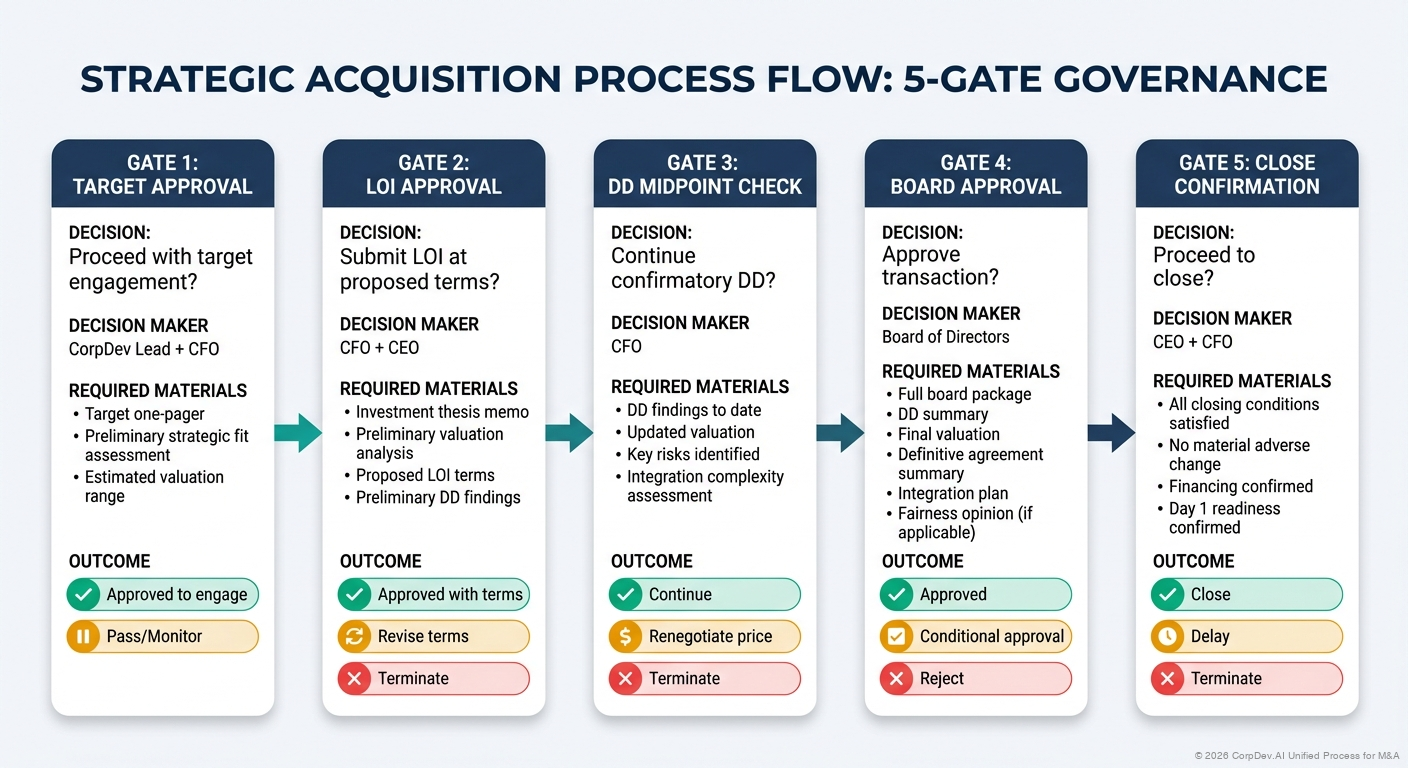

Key Milestones and Decision Points

Throughout the M&A process, several key decision points require senior management and board approval:

- Strategy Approval: Board endorsement of M&A strategy

- Proceed to LOI: Decision to submit letter of intent

- Proceed to Definitive Agreement: Post-diligence decision to move forward

- Sign Definitive Agreement: Final board approval to execute

- Integration Plan Approval: Endorsement of PMI approach

Common Timeline

While every deal is unique, a typical M&A transaction follows this rough timeline:

- Total Duration: 6-12 months from first contact to close

- Pre-LOI: 1-3 months

- LOI to Definitive Agreement: 2-3 months

- Regulatory to Close: 2-6 months

- Integration: 12-24 months

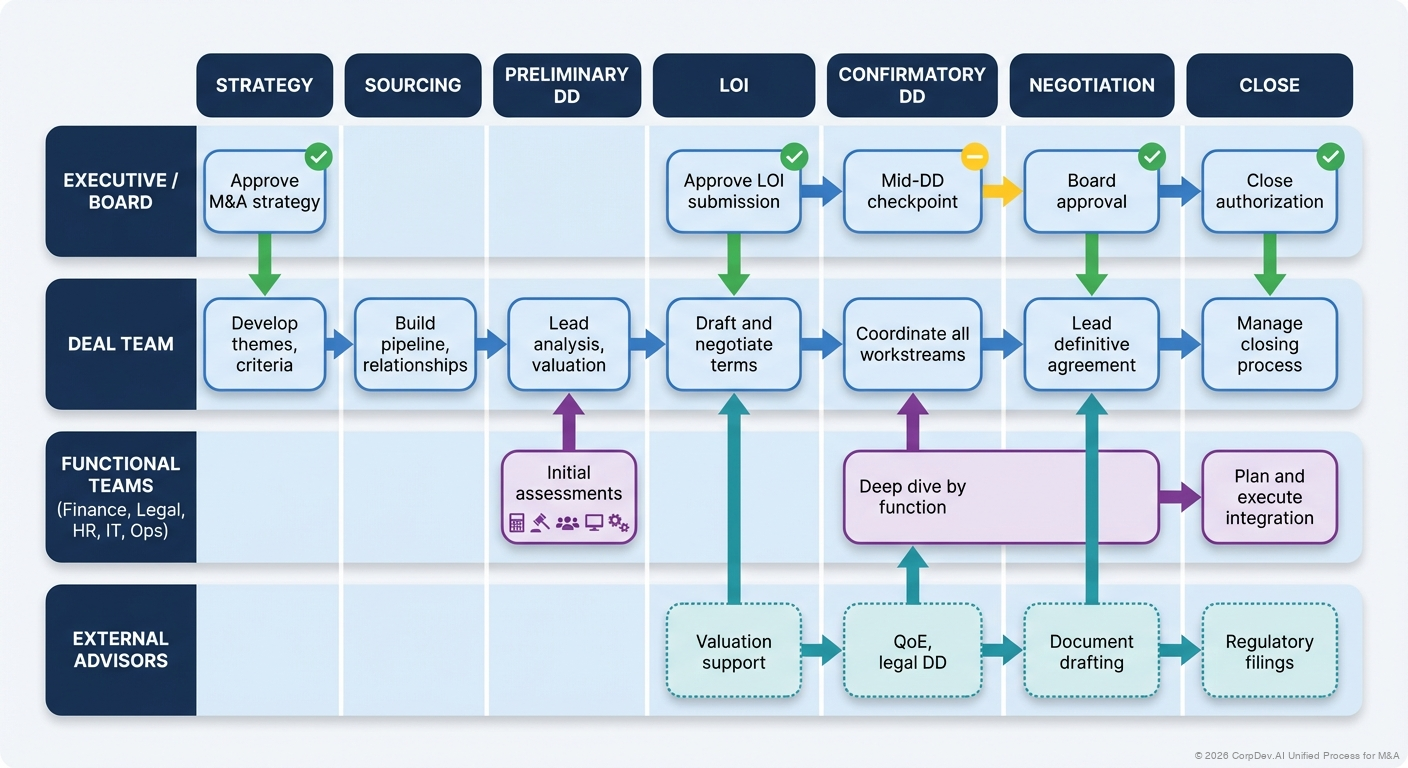

Deal Team Composition

A successful M&A transaction requires coordination across multiple functions:

Internal Team

- Corporate development lead

- Finance / FP&A

- Legal / general counsel

- Business unit leadership

- HR

- IT

- Operations

External Advisors

- Investment bankers (sell-side or buy-side)

- Legal counsel

- Accounting / financial due diligence

- Commercial due diligence consultants

- IT consultants

- HR consultants

- Industry experts

Critical Success Factors

Research shows that successful M&A transactions share several common characteristics:

- Clear Strategic Rationale: Well-defined thesis for why the deal creates value

- Disciplined Process: Rigorous evaluation and decision-making

- Thorough Due Diligence: Uncovering and addressing risks before closing

- Realistic Valuation: Avoiding overpayment and winner's curse

- Strong Integration Planning: Beginning integration planning during diligence

- Cultural Compatibility: Assessing and planning for cultural integration

- Executive Alignment: Support from senior leadership and board

References

© 2026 CorpDev.Ai Unified Process for M&A

Last updated: Wed Jan 29 2025 19:00:00 GMT-0500 (Eastern Standard Time)